The performance of DraftKings (DKNG) stock has been unimpressive, with negative returns of 8% for 2025. This does not come as a surprise, with the company missing earnings estimates in Q2 and revenue estimates in Q3. Additionally, DraftKings has lowered its revenue outlook for 2025.

While earnings have disappointed, prediction markets can be a key growth catalyst. Recently, DraftKings launched its prediction market app in 38 states, including California, Texas, and Florida.

To put things into perspective, it’s expected that prediction markets could reach one trillion dollars in trading volumes by the end of the decade. With prediction markets already launched in all 50 states, the addressable market is significant even after discounting the competition factor.

About DraftKings

Headquartered in Boston, DraftKings is a digital sports entertainment and gaming company. Currently, DraftKings Sportsbook is live with retail sports betting operations in 28 states. Further, the company’s daily fantasy sports product is available in 44 states. The recent launch of its prediction markets app in 38 states further diversifies the company’s product portfolio.

For Q3 2025, DraftKings reported revenue of $1.1 billion. For the same period, the company’s adjusted EBITDA loss was $126.5 million. Further, the number of unique customers in the prior twelve months (as of Q3 2025) was 10.8 million, which is the highest in the company’s history.

Having said that, the company’s weak financial performance and losses at the operating level have translated into DKNG stock trending lower by 14% in the past six months.

DraftKings Is Spreading Its Wings

It’s likely that DraftKings will witness earnings acceleration in the coming years. This view is underscored by the point that the company is tapping into high-growth opportunities.

As an example, the company bought Jackpocket in May 2025 for a consideration of $750 million. This allows DraftKings to diversify into the digital lottery market with an annual market size of $100 billion. With this acquisition, DraftKings expects $260 to $340 million in incremental revenue and $100 to $150 million in incremental EBITDA by FY 2026.

Similarly, the prediction markets are likely to witness fivefold growth by 2030 and will support top-line growth coupled with an improvement in EBITDA.

An important point to note is that for Q3 2024, the monthly unique payers were 3.6 million. The paying users were flat at 3.6 million for Q3 2025. However, the average revenue per paying user increased marginally from $103 to $106.

With product diversification, it’s likely that the unique payers coupled with revenue will increase. This is likely to have a positive impact on EBITDA margin. The company’s new exclusive marketing agreement with ESPN and NBCUniversal adds to the positives in terms of building a renewed growth momentum.

From a financial perspective, DraftKings ended Q3 with a cash buffer of $1.2 billion. Further, operating cash flow for the first nine months was $342 million. With high financial flexibility, the company is well positioned for aggressive diversification and to pursue potential inorganic growth.

What Analysts Say About DKNG Stock

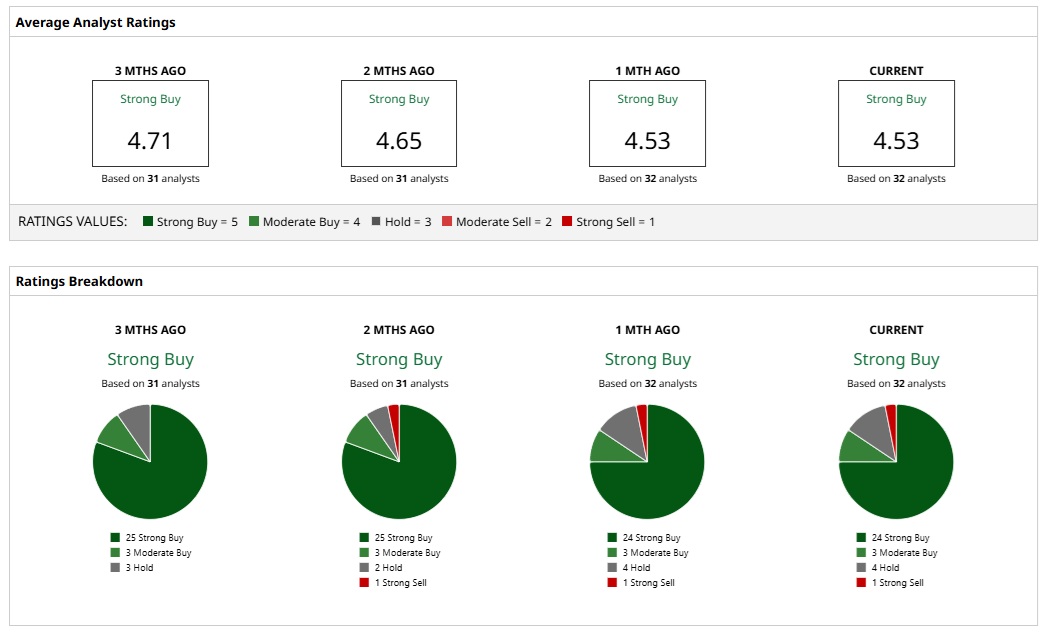

Based on the rating of 32 analysts, DKNG stock is a consensus “Strong Buy.”

While 24 analysts have assigned a “Strong Buy” rating, three and four analysts have a “Moderate Buy” and “Hold” rating, respectively. Only one analyst has assigned a “Strong Sell” rating.

Based on these ratings, the analysts have a mean price target of $44.48. This would imply an upside potential of 28%. Furthermore, considering the most bullish price target of $56, the upside potential is 61%.

An important point to note is that analysts expect earnings growth of 122.9% and 316.7% for FY 2025 and FY 2026, respectively. Given these growth estimates, the outlook seems positive for DKNG stock.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Bad News for This Michael Burry Stock Pick?

- Analysts Are Betting Big on Rivian Stock Ahead of 2026. Should You Get In on RIVN Here Too?

- DraftKings Just Launched Its Prediction Market App. Should You Make a Bet on DKNG Stock Here?

- Dear Opendoor Stock Fans, Mark Your Calendars for December 22