Wedbush analyst Dan Ives recently listed a high-profile prediction that the Trump administration will “make an equity investment in a quantum computing company,” naming IonQ (IONQ) and Rigetti (RGTI) as likely targets. News of this forecast, part of Ives’ 2026 tech outlook, added to investor interest in IonQ. The comment, part of Ives’ broader 2026 tech outlook, did not trigger a breakout rally, but it did what these calls often do: it pulled IonQ back into the market’s spotlight.

IonQ shares traded in the high-$40s in mid-December, slightly higher than where the stock sat before the prediction circulated. The reaction was restrained, which is telling. Investors have heard big-picture quantum promises before, and many now wait for proof rather than headlines.

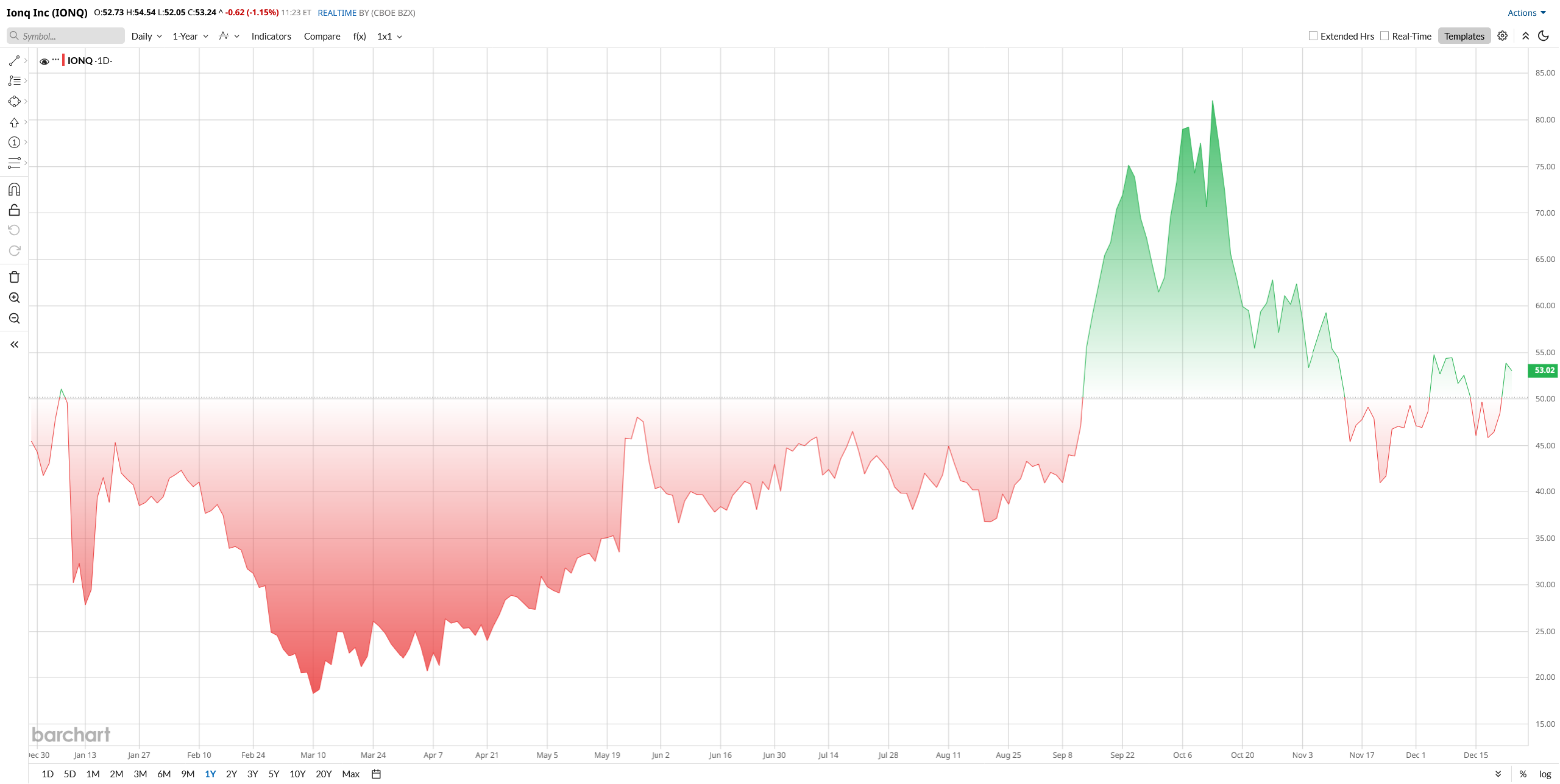

So far in 2025, IonQ is up about 28% year to date (YTD), though that number masks extreme swings. The stock surged to nearly $84 in October before giving back roughly 45% of those gains. That pattern tells us how these quantum names trade as optimism runs fast, but conviction fades just as quickly when new information fails to change the fundamentals. Acquisitions, partnerships, and bullish analyst notes have supported sentiment, but none have yet resolved the profitability question.

Trump, Dan Ives News Reality

The Trump prediction itself does not alter IonQ’s business outlook today. There is no contract, no funding commitment, and no timeline. Still, the idea matters. Government backing would be meaningful for a company like IonQ, particularly if it leads to defense- or national-security-related work. That kind of customer brings scale, long-term visibility, and credibility that few commercial buyers can match.

For now, the move looks driven more by curiosity than capital. Investors should know that IonQ’s price action continues to hinge on speculative interest tied to the promise of quantum computing rather than measurable operating progress. The real test will come when excitement fades and investors focus on whether IonQ can consistently grow commercial revenue and narrow losses.

Until then, the headlines may move the stock, but execution will decide whether those moves last.

IonQ Revenue Surges on Acquisitions

IonQ’s most recent quarterly report for Q3 2025 showed rapid top-line growth but continued heavy losses. The company reported revenue of $39.86 million, up 222% year-over-year (YoY) and well above the high end of management’s guidance, driven largely by recent acquisitions, including Capella Space and ID Quantique, as well as expanded quantum services.

Profitability, however, remains elusive. IonQ posted a net loss of roughly $1.1 billion, sharply wider than a year earlier, primarily due to non-cash stock-based compensation and elevated research and development spending. Adjusted EBITDA loss widened to about $48.9 million.

On an adjusted basis, the loss was about -$0.17 per share, compared with -$0.11 a year earlier.

Despite these heavy losses, the company ended the quarter with $1.5 billion in cash and equivalents, and following its October stock offering, pro forma liquidity stands near $3.5 billion, providing a multi-year funding runway.

Looking ahead, IonQ raised its full-year 2025 revenue outlook to roughly $106 million to $110 million while maintaining expectations for a sizable adjusted EBITDA loss of $206 million to $216 million.

What Analysts Say About IONQ Stock

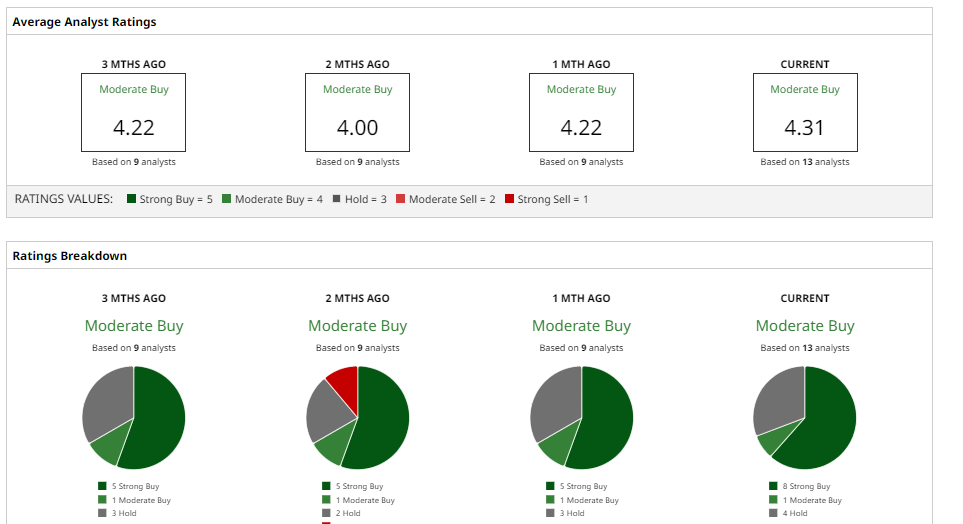

Wall Street remains divided on IONQ stock. Some analysts see long-term upside, while others urge patience.

J.P. Morgan reiterated an “Equal-Weight” rating and raised its price target to $58. The firm pointed to recent acquisitions and said management sounded more confident about new government-backed quantum programs.

Goldman Sachs kept a “Hold” rating. The firm said IonQ must show stronger, more consistent revenue growth before the valuation looks justified.

Mizuho Securities took a more bullish view. It initiated coverage with an “Outperform” rating and a $90 target. Mizuho called IonQ a leading quantum player and highlighted its trapped-ion technology, which it believes offers lower error rates and better long-term performance.

Overall, the consensus rating is “Moderate Buy” from 13 analysts covering the stock, and the mean price target sits at around $75.50, which suggests 42% upside potential.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Did the Math, and January 2026 Could Be a Prime Time to Buy Nvidia Stock

- This Software Stock Looks ‘Washed Out’ but Analysts Think 2026 Could Be Its Turnaround Year. Why?

- This Dividend Stock Just Scored an FDA Win. Should You Buy Shares Now?

- Top 100 Stocks to Buy: AMC Entertainment Partially Exited Hycroft Mining Earlier This Month. There’s Good News and Bad News for AMC Shareholders.