Oracle Corporation (ORCL) has been a headline stock in 2025, trading in a wide range as investors grapple with its ambitious pivot to cloud and artificial intelligence (AI) infrastructure. In spite of significant volatility and mixed earnings results, the tech giant’s shares have rallied on optimism surrounding its AI-driven growth prospects and major data center investments.

Now, one of Wall Street’s most vocal tech bulls, Dan Ives of Wedbush Securities, is making a bold call: Oracle could reach $250 per share in 2026, on the back of accelerating AI momentum and transformative enterprise deals that he believes will redefine the company’s long-term trajectory.

About Oracle Stock

Best known for its pioneering relational database software and enterprise tools, Oracle Corporation has evolved into a powerhouse in cloud infrastructure, SaaS applications, hardware systems, and consulting services. Headquartered in Austin, Texas, the firm serves a global client base, and with a market cap of $570 billion, the company ranks among the world’s top software and cloud computing firms.

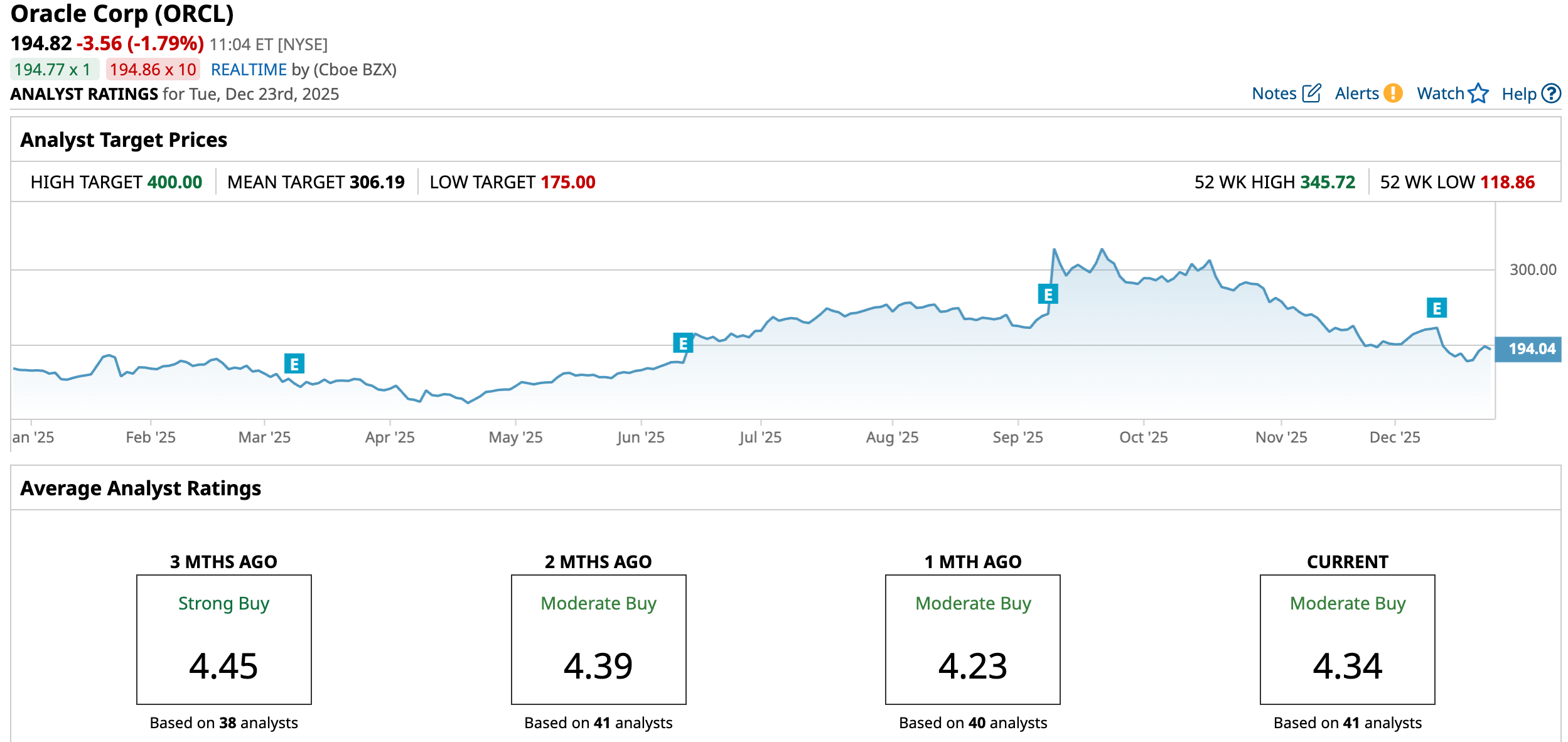

Oracle’s stock price performance over the past year has been defined by dramatic swings and intense market interest as investors reassess the company’s transformation into a cloud and AI infrastructure player. After trading as low as about $118.86 in April 2025, the share price rallied sharply through the first half of the year, propelled by strong cloud growth metrics, outsized increases in remaining performance obligations, and optimism around major deals tied to AI workloads.

This surge pushed Oracle to a 52-week high of $345.72 on Sept. 10, reflecting broad enthusiasm for its expanding Oracle Cloud Infrastructure business and the potential scale of its future revenue streams.

However, in the months that followed, the stock experienced a notable pullback as investor sentiment shifted toward concerns about the costs and execution risks tied to Oracle’s aggressive AI and cloud investments. It is currently down 43.9% from the high reached in September.

Despite this pullback, the stock is up 15.84% year-to-date (YTD) and 14.12% over the past year.

Over a longer five-year horizon, Oracle’s performance remains robust, with total returns of 206.7%, underscoring how its evolution has contributed to shareholder value despite the recent choppiness in its share price.

The stock is currently trading at a significant premium over peers and its own historical average at 32.99 times forward earnings.

Q2 Results Demonstrate Cloud Momentum

Oracle’s fiscal second-quarter 2026 performance, released on Dec. 10, offered a revealing snapshot of the company standing in its cloud and AI transition while also highlighting some of the execution challenges ahead.

The company reported total revenue of $16.1 billion, marking a 14% year-over-year (YOY) increase. Cloud revenue, which is central to Oracle’s growth strategy, climbed 34% YOY to $8 billion, driven by strong demand for both IaaS and SaaS offerings, while cloud infrastructure revenue alone was up 68% from the prior-year quarter.

This robust performance in cloud segments helped offset 3% decline in legacy software revenues. At the same time, Oracle’s remaining performance obligations surged to $523 billion, up 438% YOY, underscoring a massive backlog of multi-year cloud and AI commitments that could provide revenue visibility in the coming quarters.

Also, non-GAAP EPS stood at $2.26, representing a 54% YOY increase. While these figures comfortably beat analyst expectations for profitability, total revenue came in slightly below consensus estimates.

On the other hand, the company reported a negative free cash flow, largely due to significantly higher capital expenditures tied to its cloud and AI infrastructure build-out.

Oracle’s stock dipped almost 11% on Dec. 11, reflecting concerns that, despite strong cloud growth and a rich backlog of future business, the pace of monetization and near-term margins might not fully satisfy market expectations.

In terms of guidance, Oracle expects cloud revenue to rise 37% to 41% in constant currency in Q3, driving total revenue growth of 16% to 18%, while non-GAAP EPS is projected to increase 12% to 14%. Also, the company forecasts $4 billion of additional revenue in fiscal 2027.

What Do Analysts Expect for Oracle Stock?

Analysts led by Dan Ives believe Oracle can still reach $250 per share in 2026 if it executes on its data-center expansion plans and begins meaningfully monetizing its massive AI-driven remaining performance obligations backlog, even as the stock currently faces heavy skepticism and negative sentiment following earnings release.

Additionally, Mizuho reiterated an “Outperform” rating on Oracle this month with a $400 price target, indicating significant upside despite the stock’s recent decline and mixed fiscal Q2 results. The firm remains encouraged by Oracle’s AI infrastructure strategy.

Analysts remain optimistic as they predict EPS to be around $5.82 for fiscal 2026, up 32.3% YOY, and surge by another 8.1% annually to $6.29 in fiscal 2027.

However, RBC Capital cut its price target on Oracle to $250 from $310 while maintaining a “Sector Perform” rating, citing mixed fiscal Q2 results. The firm noted that while demand remains robust, investors are increasingly focused on capital efficiency and a clear path to margin and free-cash-flow recovery to support further upside in the stock.

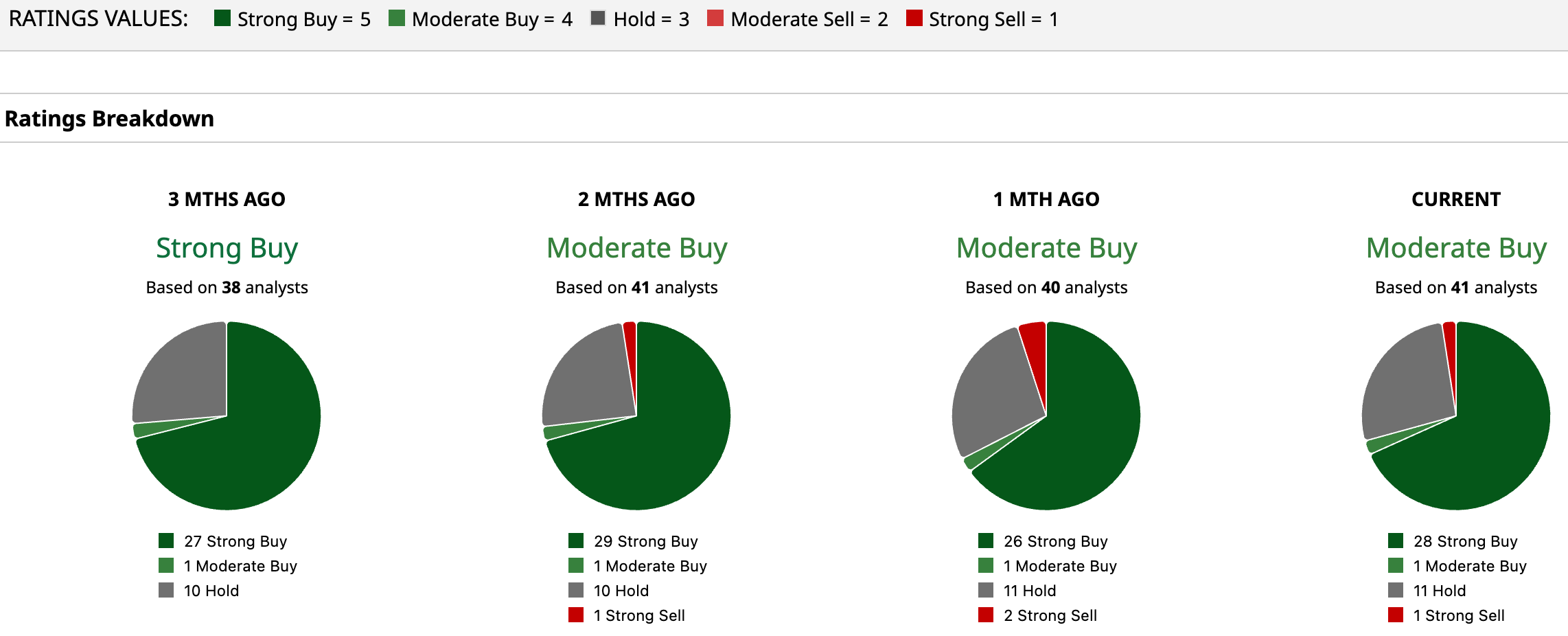

Oracle stock has a consensus “Moderate Buy” rating overall. Among the 41 analysts covering the tech stock, 28 recommend a “Strong Buy,” one gives a “Moderate Buy,” 11 analysts stay cautious with a “Hold” rating, and one gives a “Strong Sell” rating.

While its average price target of $306.19 indicates an upside of 57.17%, Mizuho’s Street-high target price of $400 suggests that the stock could rally as much as 105.3%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Did the Math, and January 2026 Could Be a Prime Time to Buy Nvidia Stock

- This Software Stock Looks ‘Washed Out’ but Analysts Think 2026 Could Be Its Turnaround Year. Why?

- This Dividend Stock Just Scored an FDA Win. Should You Buy Shares Now?

- Top 100 Stocks to Buy: AMC Entertainment Partially Exited Hycroft Mining Earlier This Month. There’s Good News and Bad News for AMC Shareholders.