OREM, Utah, April 30, 2025 (GLOBE NEWSWIRE) -- SunPower, formerly d/b/a Complete Solaria, Inc. (“SunPower” or the “Company”) (Nasdaq: SPWR), a solar technology, services, and installation company, will present its 2024 and Q1’25 results via webcast at 1:00pm ET on Wednesday, April 30. Interested parties may access the webcast by registering here or by visiting the Events page within the IR section of the company website: https://investors.sunpower.com/news-events/events.

Please see our SunPower rebranding announcement on the back page of the April 29 print version of the Wall Street Journal or on the mobile app for the WSJ print version, where it will reside for the next week.

SunPower chairman and CEO, T.J. Rodgers commented, “This is the Company’s second quarterly report after the SunPower asset purchase on September 30, 2024, and our first report as SunPower, after rebranding with that name on April 21, 2025. The rebranding also fortuitously coincides with SunPower’s first profitable quarter in four years.”

| SunPower Revenue & Operating Income | |||||||||||

| Our First Two Quarters as SunPower | |||||||||||

| GAAP2 | NON-GAAP | ||||||||||

| ($1000s, except gross margin) | Q1 2025 | Q4 2024 | Q1 20253 | Q4 2024 | |||||||

| Revenue | 80,174 | 88,674 | 80,174 | 88,674 | 4 | ||||||

| Gross Margin | 36 | % | 47 | % | 36 | % | 47 | %4 | |||

| Operating Expenses | 27,366 | 62,769 | 27,366 | 62,769 | |||||||

| Operating Expenses | 12,270 | 49,870 | 12,270 | 49,870 | |||||||

| Less Commission | |||||||||||

| Operating Income/(Loss) | (8,876 | ) | (21,501 | ) | 1,274 | (5,940 | ) | ||||

| Cash Balance5 | 13,995 | 13,308 | 13,995 | 13,308 | |||||||

_____________________________________

1 Operating profit based on the non-GAAP results posted on our website [us.sunpower.com].

2 To see our audited 2024 GAAP financial statements, go to the SEC 10K filing on our website [us.sunpower.com].

3 Our non-GAAP financials are used to run the company and differ from the official GAAP report in three ways: 1) no non-cash amortization of intangibles, no employee stock compensation charges (already reflected in share count by dilution) and no one-time events, including favorable and unfavorable events. (See note 4.)

4 The Q4’24 revenue and gross margin reported in our unaudited January 21, 2025 shareholder letter were lower, $81,103 and 37%, respectively. These figures were accurate and conformed to our CSLR revenue recognition standards on that date. The numbers presented here are calculated using the harmonized revenue recognition standards for the combined company from the audited 2024 results. Internally, we use our original Q4’24 forecast to judge our performance. For example, the 47% Q4’24 gross margin is inflated by jobs bought from SunPower at no COGS cost, and should not be used in a forward-looking projections.

5 Cash balance is exclusive of restricted cash.

Fellow Shareholders:

Our Q1’25 revenue, earnings and cashflow are given above. They feature identical GAAP and non-GAAP results for the quarter, except for GAAP operating income, which contains charges from depreciation and amortization of intangible assets, stock-based compensation charges, and non-recurring events, mostly from the asset purchase.

Rodgers added, “I congratulate our team for breaking the profit barrier just 180 days after launch, despite enduring layoffs and some hard times in the solar industry. The rest of this report will focus on our other important first-quarter accomplishments.”

Summary of SunPower Q1’25 Accomplishments

- Our $80.2 million Q1’25 revenue was in line with expectations, and it was achieved in the traditionally difficult winter quarter. (For example, Blue Raven operates in the Midwest and often has to remove snow from customers’ roofs during winter.)

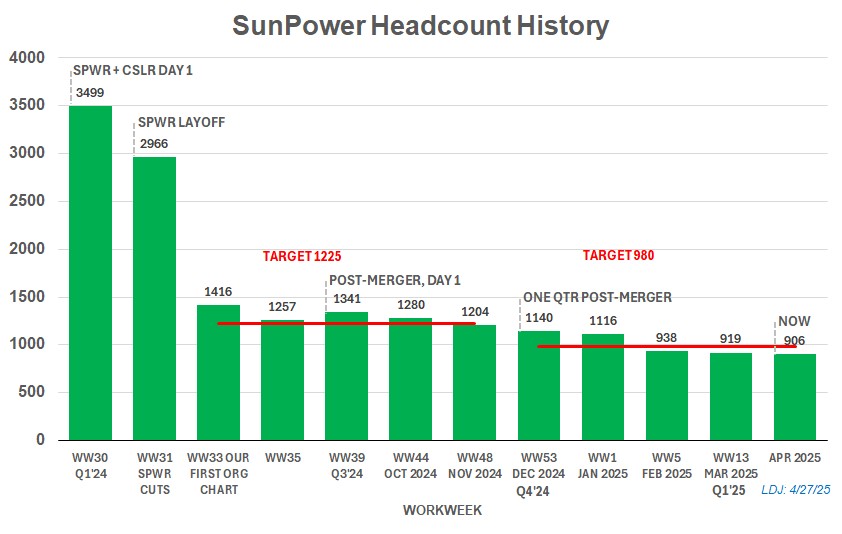

- SunPower is now properly and leanly staffed. The new SunPower was launched with the combined headcounts of Complete Solar, SunPower and Blue Raven Solar – 3,499 employees – on October 1, 2024. We reduced the staffing by 3x, to 1,140 one quarter later, as graphed below. Our final headcount target for the combined company was first set at 1,225 and then lowered to 980. We are currently ahead of that plan with 906 employees. We are at the right headcount to be profitable at $300 million in annualized revenue.

- Key new employees. We are now able to recycle a fraction of the salaries saved from headcount reductions to bring in key industry players. For example, we hired Dr. Richard Swanson, the Stanford technical genius and founder of SunPower, to advise us on technology, as well as our new CTO, Dr. Mehran Sedigh, a storage expert who ran the Enphase Battery business unit and ramped it to its current $500 million in revenue.

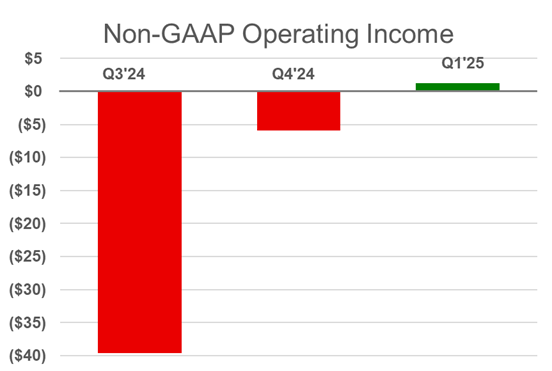

- Our headcount and cost reductions led to $1.3 million operating income in Q1’25. Our continuous cost-cutting measures have improved our operating income over the last three quarters from a $39.6 million loss in Q3’24 (unofficial sum of losses for three companies), to a loss of $5.9 million in Q4’24 (audited), to an operating profit of $1.3 million in Q1’25.

- Our cash balance grew (slightly). We finished Q1’25 with $14.0 million in cash versus $13.3 million in Q4’24.

Outlook

We forecast steady revenue and positive operating income again next quarter. We will provide a more detailed forecast and growth plan during our May annual meeting.

Subsequent Events

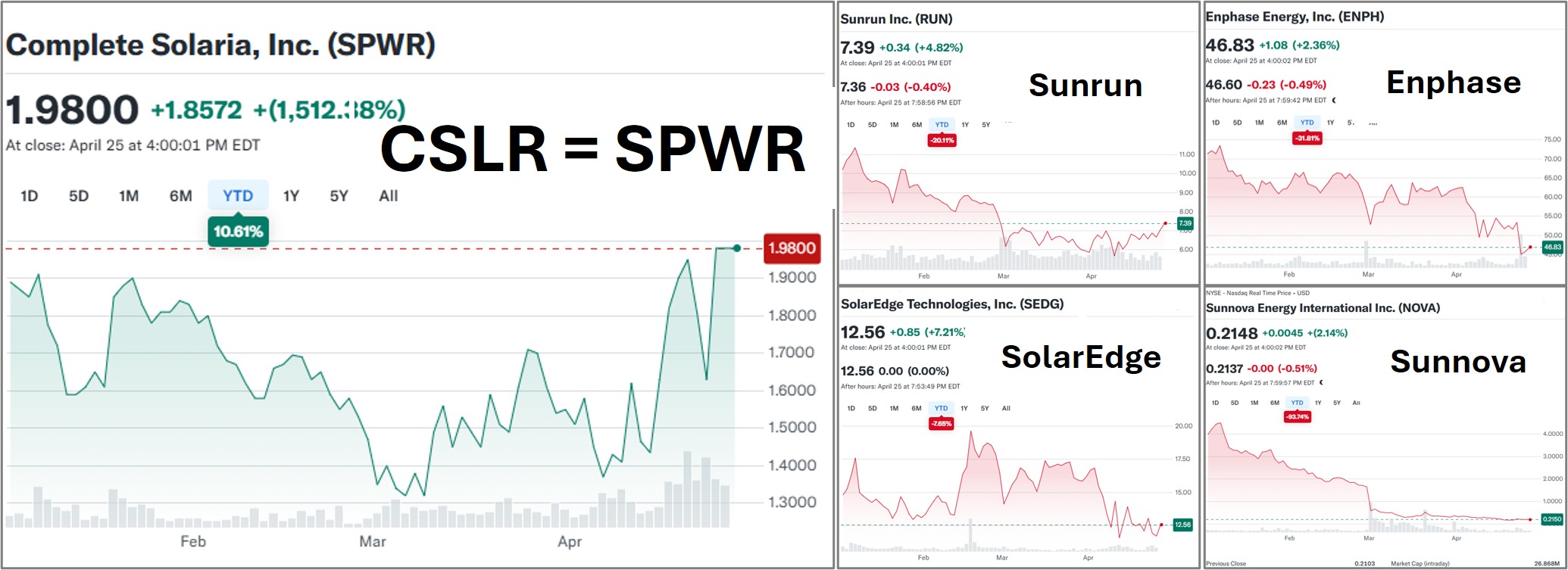

We are now SunPower (Nasdaq: SPWR). On April 21, the Company announced it has rebranded as SunPower, a tradename we own. The company’s ticker symbols have been changed from “CSLR” and “CSLRW” to “SPWR” and “SPWRW”, respectively, effective April 22, 2025.

Strategic partnership with Sunder. We have partnered with Sunder, a large, highly regarded Salt-Lake area solar sales firm. They are now supporting our growth, which should start to show up on the top line in Q3’25.

We strengthened our board with three pubic-company ex-CEO directors: Lothar Maier, former CEO of Linear Technology, a $1.4 billion Silicon Valley chip company; Dan McCranie, the former chairman of five high-tech companies, including Freescale and On, the two public companies spun out by Motorola Semiconductor; and Jamie Haenggi, the former CEO of ADT Solar.

We have a fully independent board. A current independent director, Ron Pasek, now has been named the Lead Director for the corporation and Dan McCranie has been named as the Compensation Committee Chairman serving respectively for T.J. Rodgers (Chairman) and Tony Alvarez (Compensation Committee Chair) who are not independent directors because they worked for the company or a predecessor company in the last five years.

| SunPower Board (4/30/25) | ||||

| DIRECTOR | STATUS | PRIOR | DEGREE/UNIVERSITY | SOLAR VETERAN (Bolded) |

| Tony Alvarez | CEO | BEE Georgia Tech, MSEE Georgia Tech | Complete Solar, SunEdison, ChipMOS, Cypress* | |

| Will Anderson | CEO | BS Mgmt Science MIT, MBA Stanford | Same Day Solar, Complete Solar | |

| Adam Gishen | I | VPIR | BS Int'l Studies Univ. of Leeds | Credit Suisse, Ondra, Lehman Bros. |

| *Jamie Haenggi | I | CEO | BS Int'l Relations Univ. of Minnesota | ADT Solar, Vonage |

| Chris Lundell | CEO | BS Finance, MBA Finance BYU | Vivint, DOMO, Novell | |

| *Lothar Maier | I | CEO | BS Chemical Eng UC Berkley | Linear Tech, Cypress |

| *Dan McCranie | I | CEO | BS EE Virginia Tech | ENVX, Cypress Semi, SEEQ, AMD |

| Ron Pasek | I | CFO | BS Finance SJSU, MBA Santa Clara | NetApp, Alterra, Sun Micro |

| T.J Rodgers | CEO | BA Dartmouth, MA/PhD EE Stanford | SunPower, Complete Solar, Enphase, Cypress | |

| Tidjane Thiam | I | CEO | BS Ecole Polytechnique, MBA INSEAD | Credit Suisse, Prudential, Aviva, McKinsey & Co. |

| Devin Whatley | I | VC | BA East Asian Studies UCLA, MBA Penn | Ecosystem Integrity Fund, Zep Solar, Pegasus |

| * New (3) | Independent (64%) | *Cypress Semiconductor Corporation | ||

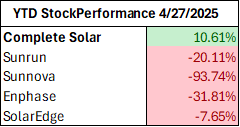

Rodgers concluded, “Our successive $80 million-plus quarters re-define our Company with an annualized revenue of $300 million-plus, now producing a $1 million-plus quarterly operating profit. The market is beginning to recognize that fact.”

About SunPower

SunPower has become a leading residential solar services provider in North America. SunPower’s digital platform and installation services support energy needs for customers wishing to make the transition to a more energy-efficient lifestyle. For more information visit www.sunpower.com.

Non-GAAP Financial Measures

In addition to providing financial measurements based on generally accepted accounting principles in the United States of America ("GAAP"), SunPower provides an additional financial metrics in this press release that are not prepared in accordance with GAAP ("non-GAAP"). Management believes the non-GAAP financial measures, in addition to GAAP financial measures, are useful measures of operating performance because the non-GAAP financial measure does not include the impact of items that management does not consider indicative of SunPower’s operating performance, such as amortization of goodwill and expensing employee stock options in addition to accounting for their dilutive effect, which facilitates the analysis of the company’s core operating results across reporting periods. The non-GAAP financial measures do not replace the presentation of SunPower’s GAAP financial results and should only be used as a supplement to, not as a substitute for, SunPower’s financial results presented in accordance with GAAP. Descriptions of and reconciliations of the non-GAAP financial measures used in this press release are included in the financial table above and related footnotes. We encourage investors to carefully consider our preliminary results under GAAP, as well as our preliminary non-GAAP information and the reconciliations between these presentations, to more fully understand our business. Non-GAAP financial measures are reported in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about us and our industry that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “will,” “goal,” “prioritize,” “plan,” “target,” “expect,” “focus,” “forecast,” “look forward,” “opportunity,” “believe,” “estimate,” “continue,” “anticipate,” and “pursue” or the negative of these terms or similar expressions. Forward-looking statements in this press release include, without limitation, our Q1’25 revenue projection, our expectations regarding our Q1’25 and fiscal 2025 financial performance, including with respect to our Q1’25 and fiscal 2025 combined revenues and profit before tax loss, expectations and plans relating to further headcount reduction, cost control efforts, and our expectations with respect to when we achieve breakeven operating income and positive operating income, including our forecast to be operating income breakeven in Q2’25. Actual results could differ materially from these forward-looking statements as a result of certain risks and uncertainties, including, without limitation, our ability to implement further headcount reductions and cost controls, our ability to integrate and operate the combined business with the SunPower assets, our ability to achieve the anticipated benefits of the SunPower acquisition, global market conditions, any adjustments, changes or revisions to our financial results arising from our financial closing procedures, the completion of our audit and financial statements for Q1’25 and fiscal 2025, and other risks and uncertainties applicable to our business. For additional information on these risks and uncertainties and other potential factors that could affect our business and financial results or cause actual results to differ from the results predicted, readers should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of our annual report on Form 10-K to be filed with the SEC on April 30, 2025, our quarterly reports on Form 10-Q filed with the SEC and other documents that we have filed with, or will file with, the SEC. Such filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements in this press release speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and SunPower assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Preliminary Unaudited Financial Results

The selected unaudited financial results for the Q1’25 are preliminary and subject to our quarter and year-end accounting procedures and external audit by our independent registered accounting firm. As a result, the financial results presented in this press release may change in connection with the finalization of our closing and reporting processes and financial statements for Q1’25 and fiscal 2025 and may not represent the actual financial results for such quarter and full year. In addition, the information in this press release is not a comprehensive statement of our financial results for Q1’25 or the 2025 fiscal year, should not be viewed as a substitute for full, audited financial statements prepared in accordance with generally accepted accounting principles, and are not necessarily indicative of our results for any future period.

Company Contacts:

| Dan Foley CFO daniel.foley@SunPower.com (858) 212-9594 | Sioban Hickie VP Investor Relations & Marketing IR@SunPower.com (801) 477-5847 |

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (PRELIMINARY) | |||||||||||

| (In Thousands) | |||||||||||

| COMPLETE SOLARIA, INC. - AS REPORTED | SPWR - Unaudited | ||||||||||

| 13 weeks ended | 13 weeks ended | 13 weeks ended | *13 weeks ended | *13 weeks ended | |||||||

| March 31, 2024 | June 30, 2024 | 29-Sep-24 | 29-Dec-24 | 30-Mar-24 | |||||||

| GAAP operating loss from continuing operations | (7,544) | (9,494) | (29,770) | (21,501) | (8,876) | ||||||

| Note | |||||||||||

| Depreciation and amortization | A | 357 | 329 | 305 | 1,745 | 1,146 | |||||

| Stock based compensation | B | 1,341 | 1,229 | 1,516 | (1,019) | 5,756 | |||||

| Restructuring charges | C | 406 | 2,603 | 21,072 | 14,835 | 3,248 | |||||

| Total of Non-GAAP adjustments | 2,104 | 4,161 | 22,893 | 15,561 | 10,150 | ||||||

| Non-GAAP net loss | (5,440) | (5,333) | (6,877) | (5,940) | 1,274 | ||||||

| Notes: | |||||||||||

| (A) Depreciation and amortization: Depreciation and amortization related to capital expenditures. | |||||||||||

| (B) Stock-based compensation: Stock-based compensation relates to our equity incentive awards and for services paid in warrants. Stock-based compensation is a non-cash expense. | |||||||||||

| (C) Acquisition Costs: Costs primarily related to acquisition, headcount reductions (i.e. severance), legal, professional services (i.e. historical carveout audits) and due diligence. | |||||||||||

| *Reflects the acquisition of the SunPower Assets which Complete Solaria acquired on 9/30/24. | |||||||||||

Source: SunPower

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/2ac50cb4-e2ec-4521-b6a3-7c8998a1e039

https://www.globenewswire.com/NewsRoom/AttachmentNg/567b6c1e-0669-48f2-a82e-fd31476f2ffe

https://www.globenewswire.com/NewsRoom/AttachmentNg/1baa11af-22b3-414f-8dbb-f9ad3c75808a

https://www.globenewswire.com/NewsRoom/AttachmentNg/9ceb6148-b2e7-41bf-873e-4ed60af1abd0