Pet products provider Bark (NYSE:BARK) reported Q3 CY2025 results exceeding the market’s revenue expectations, but sales fell by 15.2% year on year to $107 million. On the other hand, next quarter’s revenue guidance of $102.5 million was less impressive, coming in 4% below analysts’ estimates. Its non-GAAP loss of $0.03 per share was $0.02 below analysts’ consensus estimates.

Is now the time to buy Bark? Find out by accessing our full research report, it’s free for active Edge members.

Bark (BARK) Q3 CY2025 Highlights:

- Revenue: $107 million vs analyst estimates of $104.3 million (15.2% year-on-year decline, 2.6% beat)

- Adjusted EPS: -$0.03 vs analyst estimates of -$0.02 ($0.02 miss)

- Adjusted EBITDA: -$1.44 million vs analyst estimates of $267,670 (-1.3% margin, significant miss)

- Revenue Guidance for Q4 CY2025 is $102.5 million at the midpoint, below analyst estimates of $106.7 million

- EBITDA guidance for Q4 CY2025 is -$3 million at the midpoint, below analyst estimates of -$1.43 million

- Operating Margin: -10%, down from -4.5% in the same quarter last year

- Free Cash Flow was -$19.93 million, down from $966,000 in the same quarter last year

- Market Capitalization: $134.2 million

“Last week, we repaid our $45 million convertible note with cash on hand—making BARK debt-free—and extended our $35 million line of credit to preserve flexibility. These actions strengthen our foundation and allow us to focus on what matters most—serving dog parents. Even in a noisy macro environment, we’re operating from a position of strength and building a healthier, more diversified company that continues to show up for dogs and their people in more ways than ever,” said Matt Meeker, Co-Founder and Chief Executive Officer of BARK.

Company Overview

Making a name for itself with the BarkBox, Bark (NYSE:BARK) specializes in subscription-based, personalized pet products.

Revenue Growth

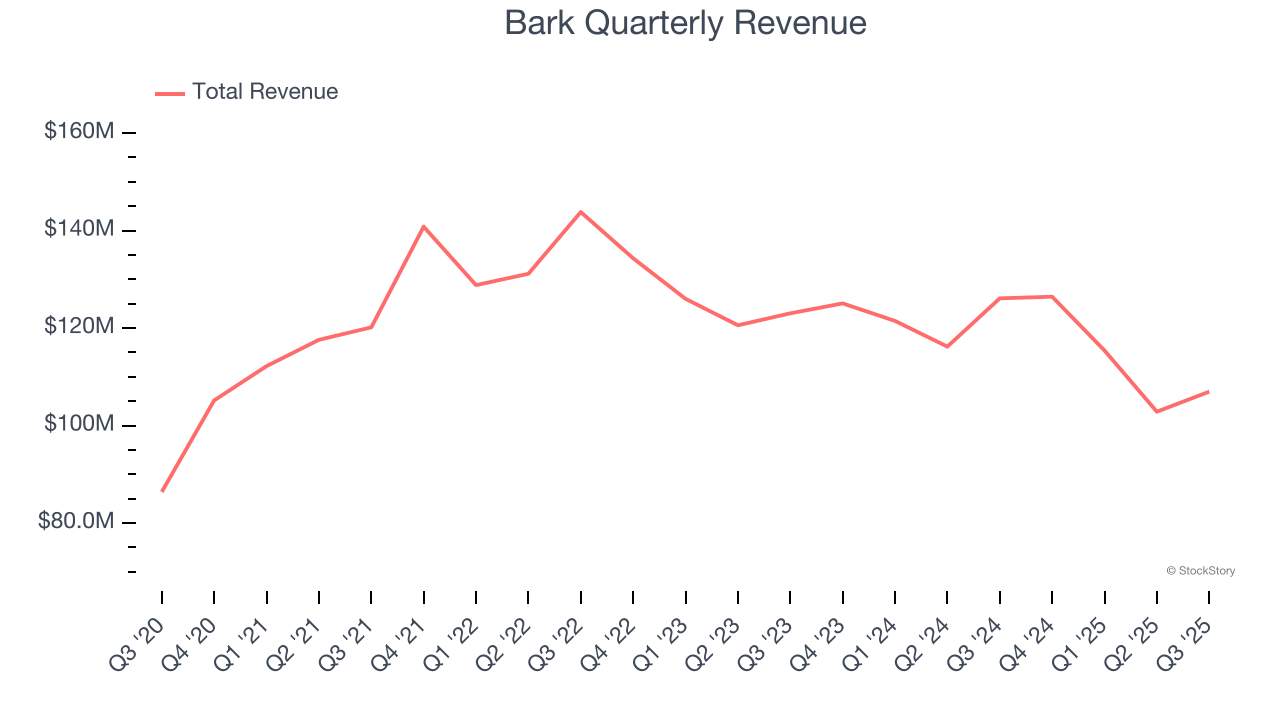

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Bark’s sales grew at a tepid 9.8% compounded annual growth rate over the last five years. This fell short of our benchmark for the consumer discretionary sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Bark’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 5.3% annually.

This quarter, Bark’s revenue fell by 15.2% year on year to $107 million but beat Wall Street’s estimates by 2.6%. Company management is currently guiding for a 18.9% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 5.3% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not accelerate its top-line performance yet.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

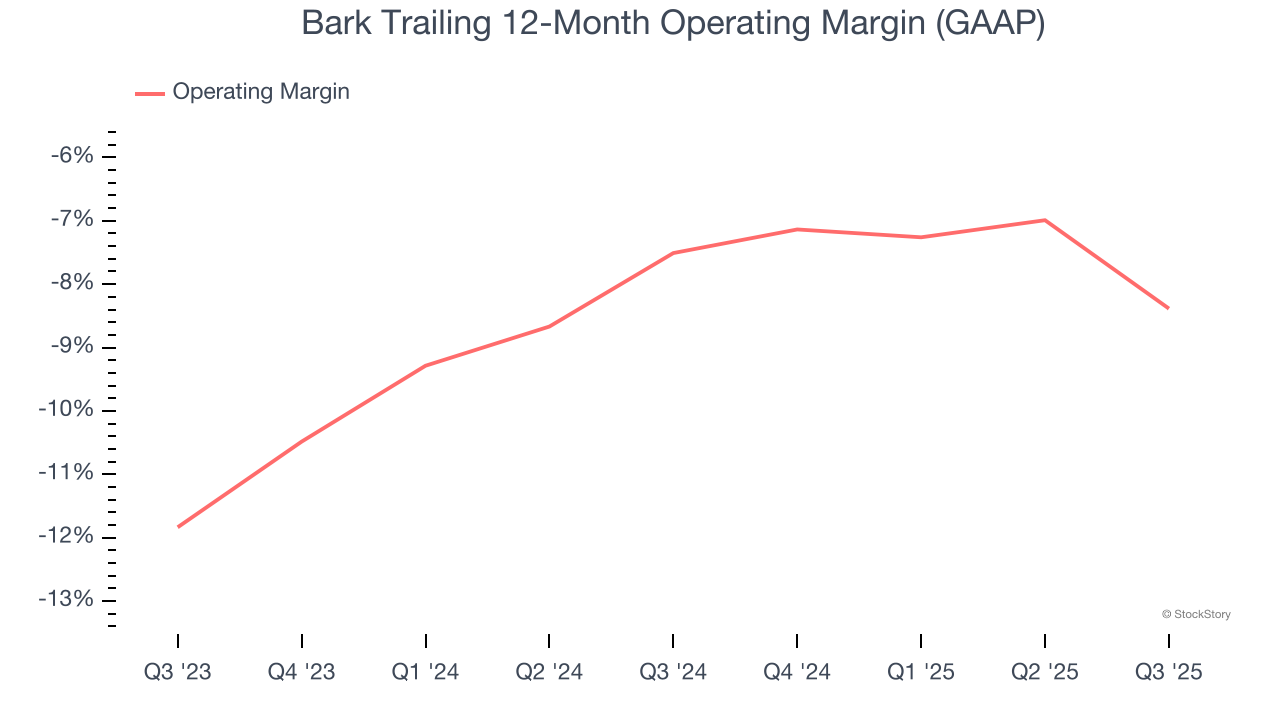

Bark’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging negative 7.9% over the last two years. Unprofitable consumer discretionary companies that fail to improve their losses or grow sales rapidly deserve extra scrutiny. For the time being, it’s unclear if Bark’s business model is sustainable.

This quarter, Bark generated a negative 10% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

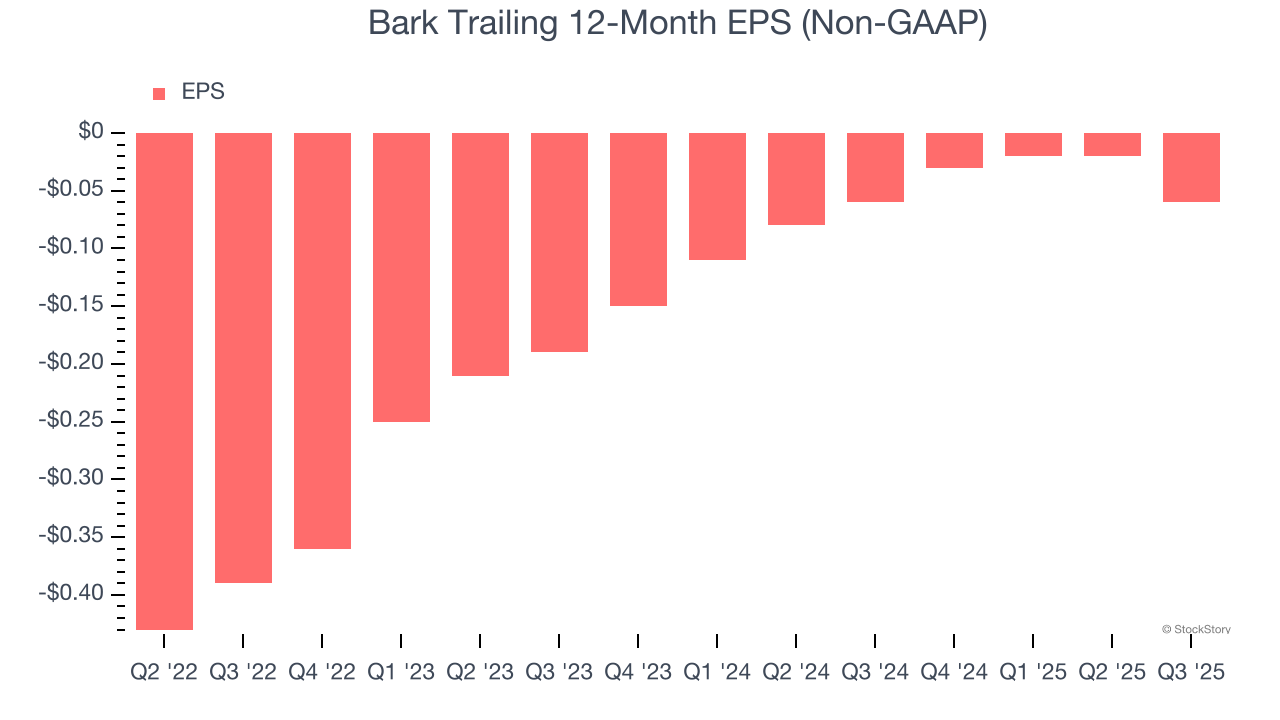

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

In Q3, Bark reported adjusted EPS of negative $0.03, down from $0.01 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Bark’s full-year EPS of negative $0.06 to stay about the same.

Key Takeaways from Bark’s Q3 Results

It was encouraging to see Bark beat analysts’ revenue expectations this quarter. On the other hand, its EPS was just in line with Wall Street’s estimates and revenue guidance fell below estimates. Overall, this was a weaker quarter. The stock traded up 1.2% to $0.81 immediately after reporting.

Big picture, is Bark a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.