Financial brokerage and technology company BGC Group (NASDAQ:BGC) met Wall Streets revenue expectations in Q3 CY2025, with sales up 37.5% year on year to $736.8 million. The company expects next quarter’s revenue to be around $745 million, coming in 1.4% above analysts’ estimates. Its non-GAAP profit of $0.29 per share was in line with analysts’ consensus estimates.

Is now the time to buy BGC? Find out by accessing our full research report, it’s free for active Edge members.

BGC (BGC) Q3 CY2025 Highlights:

Company Overview

Tracing its roots back to 1945 and named after founder Bernard Gerald Cantor, BGC Group (NASDAQ:BGC) operates a global brokerage and financial technology platform that facilitates trading across fixed income, foreign exchange, equities, energy, and commodities markets.

Revenue Growth

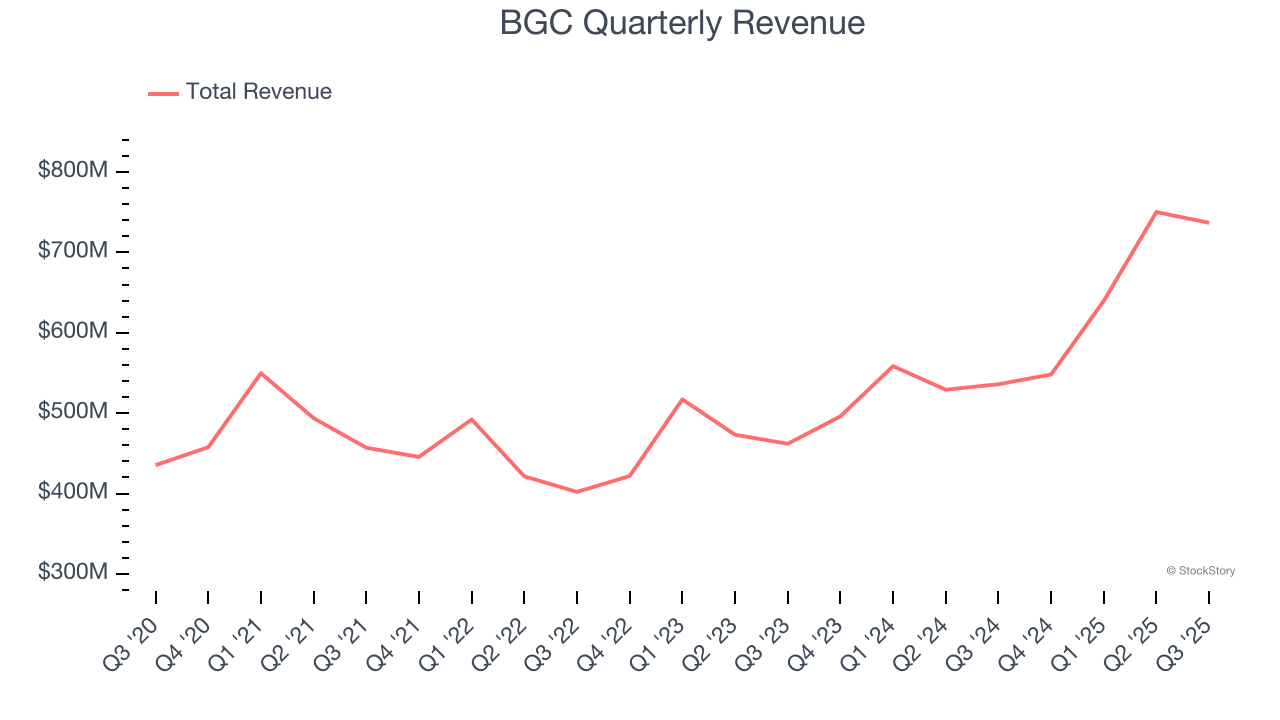

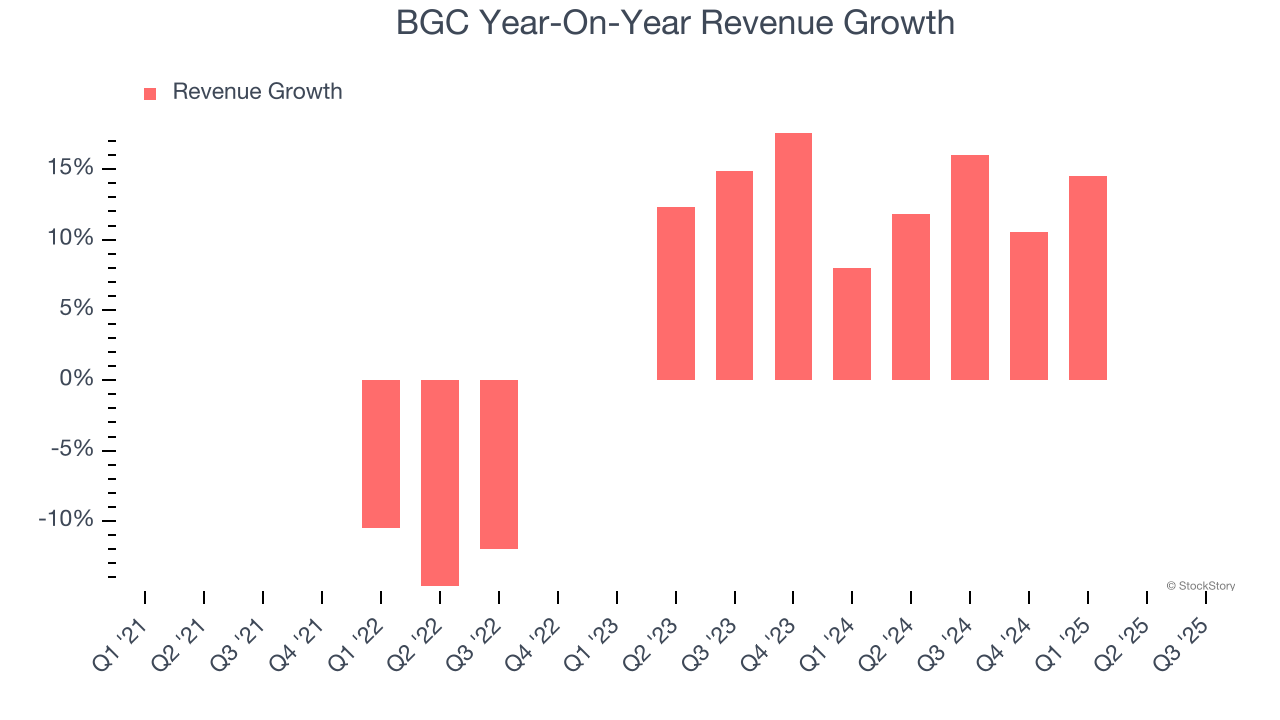

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, BGC’s 6.9% annualized revenue growth over the last five years was mediocre. This wasn’t a great result compared to the rest of the financials sector, but there are still things to like about BGC.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. BGC’s annualized revenue growth of 19.5% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, BGC’s year-on-year revenue growth of 37.5% was wonderful, and its $736.8 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 35.9% year-on-year increase in sales next quarter.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Key Takeaways from BGC’s Q3 Results

BGC met analysts’ revenue and EPS expectations this quarter. Zooming out, we think this was an in line quarter without many surprises. The stock traded up 3.9% to $9.49 immediately following the results.

So should you invest in BGC right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.