Radiopharmaceutical company Lantheus Holdings (NASDAQ:LNTH) announced better-than-expected revenue in Q3 CY2025, with sales up 1.4% year on year to $384 million. The company’s full-year revenue guidance of $1.5 billion at the midpoint came in 1.1% above analysts’ estimates. Its non-GAAP profit of $1.27 per share was in line with analysts’ consensus estimates.

Is now the time to buy Lantheus? Find out by accessing our full research report, it’s free for active Edge members.

Lantheus (LNTH) Q3 CY2025 Highlights:

- Revenue: $384 million vs analyst estimates of $365 million (1.4% year-on-year growth, 5.2% beat)

- Adjusted EPS: $1.27 vs analyst estimates of $1.27 (in line)

- Adjusted EBITDA: $82.76 million vs analyst estimates of $113.7 million (21.5% margin, 27.2% miss)

- The company slightly lifted its revenue guidance for the full year to $1.5 billion at the midpoint from $1.49 billion

- Management reiterated its full-year Adjusted EPS guidance of $5.58 at the midpoint

- Operating Margin: 11.4%, down from 35.3% in the same quarter last year

- Free Cash Flow Margin: 24.7%, down from 42% in the same quarter last year

- Market Capitalization: $3.89 billion

“Lantheus’ third quarter results underscore the strength of our strategy and the dedication of our team as we continue to advance our leadership in radiopharmaceuticals,” said Brian Markison, CEO.

Company Overview

Pioneering the "Find, Fight and Follow" approach to disease management, Lantheus Holdings (NASDAQGM:LNTH) develops and commercializes radiopharmaceuticals and other imaging agents that help healthcare professionals detect, diagnose, and treat diseases.

Revenue Growth

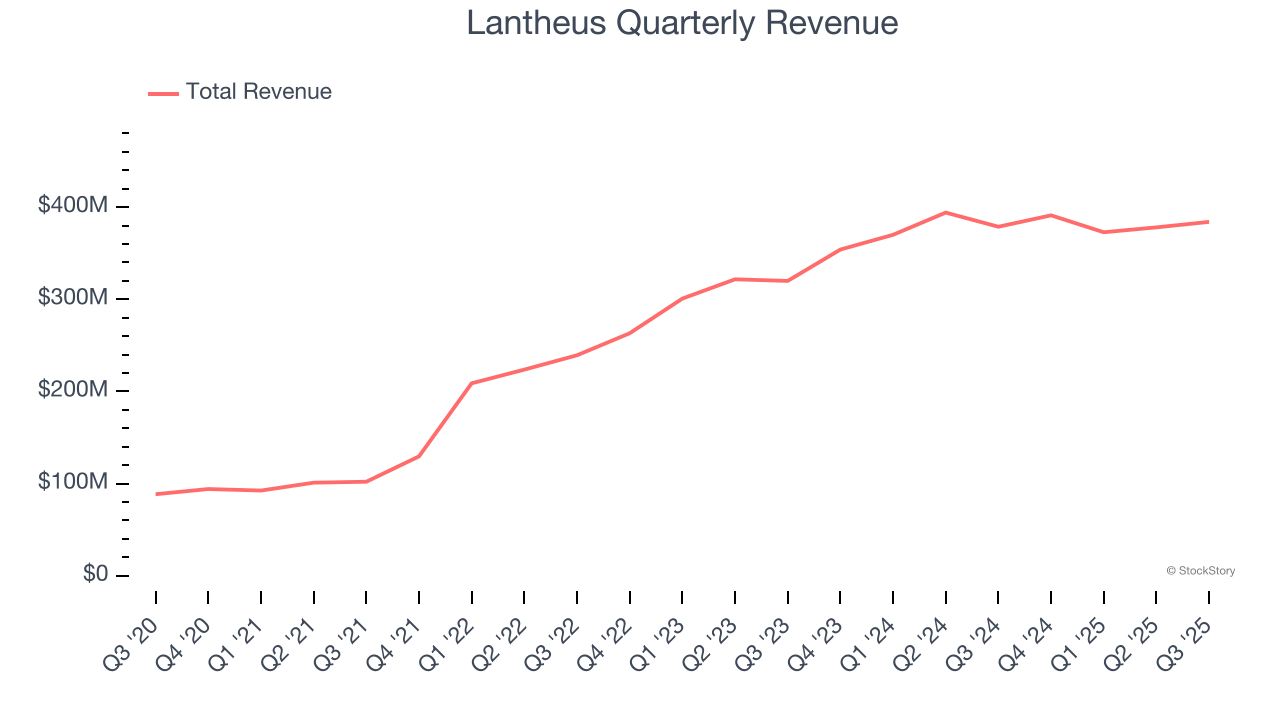

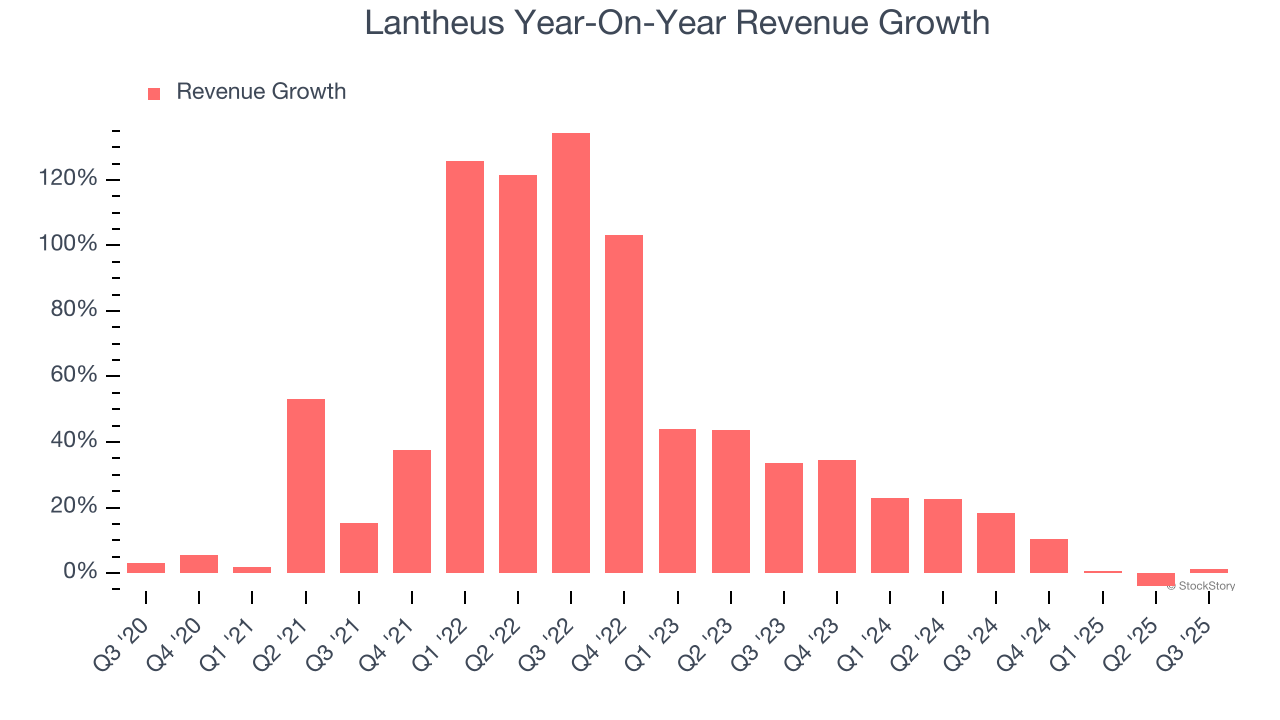

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Lantheus’s sales grew at an incredible 35.5% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Lantheus’s annualized revenue growth of 12.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Lantheus reported modest year-on-year revenue growth of 1.4% but beat Wall Street’s estimates by 5.2%.

Looking ahead, sell-side analysts expect revenue to decline by 5.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

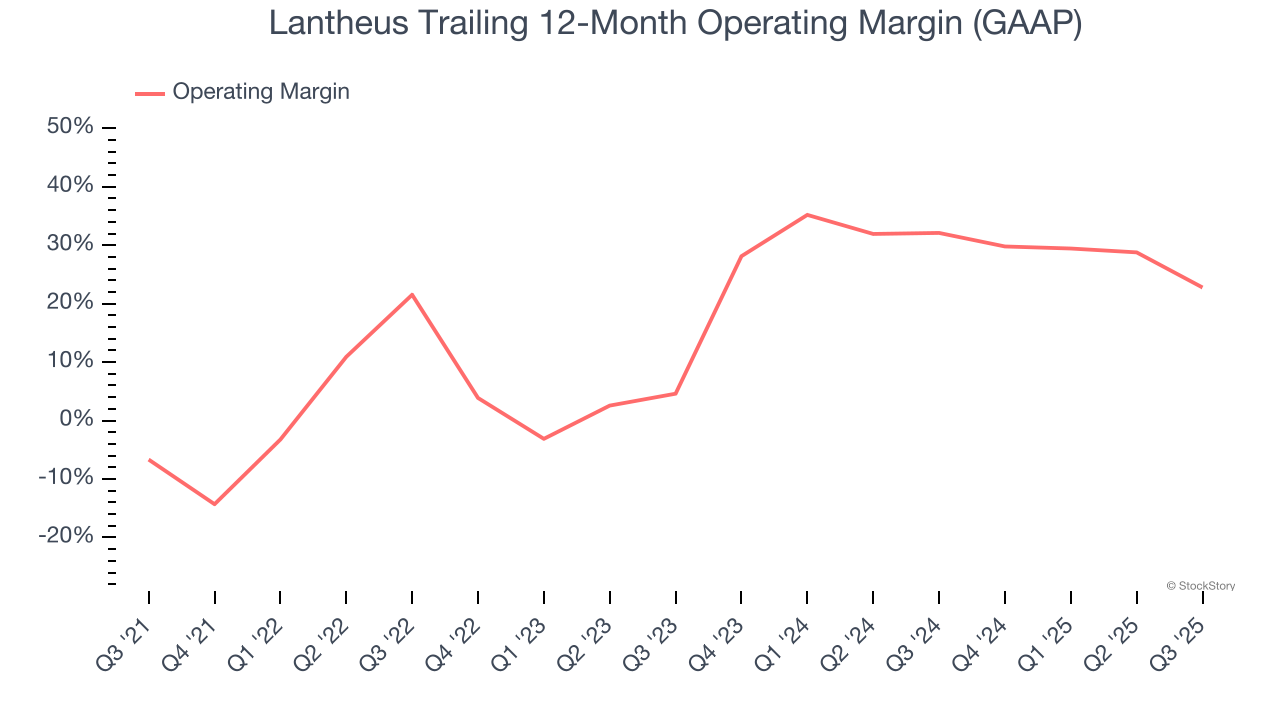

Lantheus has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 19%.

Looking at the trend in its profitability, Lantheus’s operating margin rose by 29.4 percentage points over the last five years, as its sales growth gave it immense operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 18.2 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

This quarter, Lantheus generated an operating margin profit margin of 11.4%, down 24 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

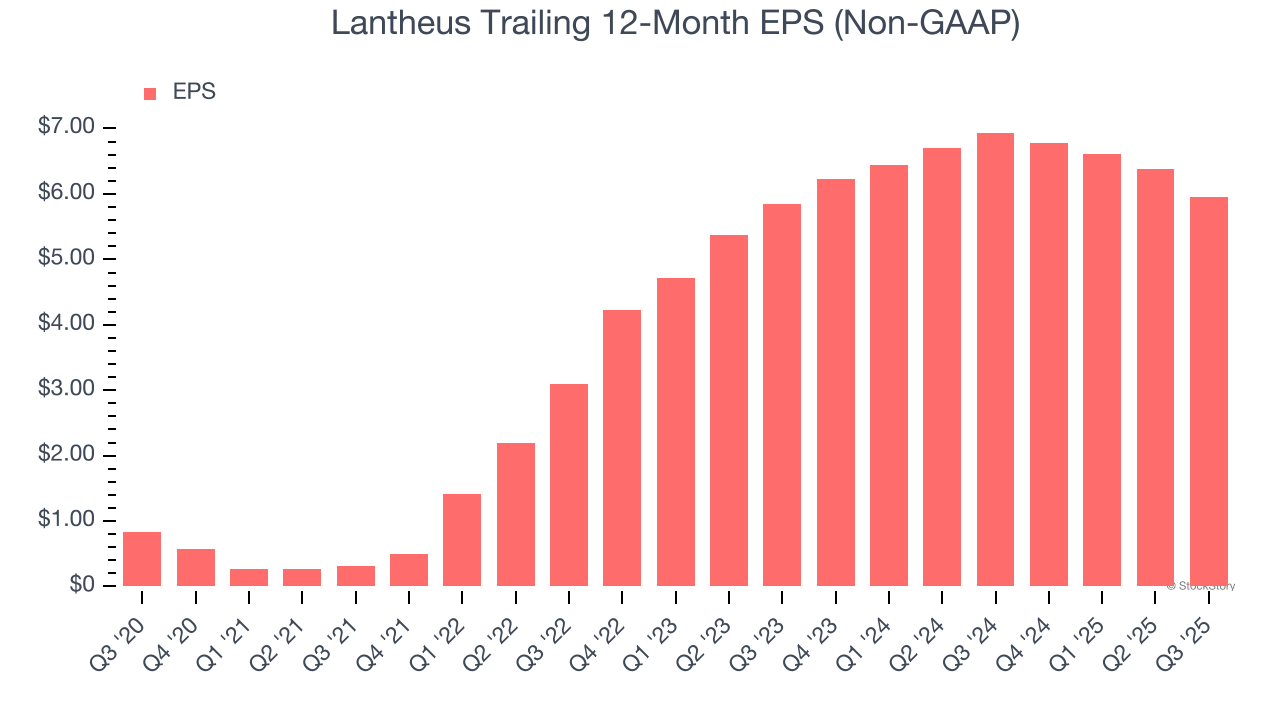

Lantheus’s EPS grew at an astounding 48.1% compounded annual growth rate over the last five years, higher than its 35.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Lantheus’s earnings to better understand the drivers of its performance. As we mentioned earlier, Lantheus’s operating margin declined this quarter but expanded by 29.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Lantheus reported adjusted EPS of $1.27, down from $1.70 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Lantheus’s full-year EPS of $5.96 to shrink by 16.2%.

Key Takeaways from Lantheus’s Q3 Results

We were impressed by how significantly Lantheus blew past analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. On the other hand, its full-year EPS guidance slightly missed. Overall, this print had some key positives. The stock traded up 7.5% to $61.50 immediately after reporting.

Lantheus may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.