Automotive manufacturer General Motors (NYSE:GM) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, with sales up 2.3% year on year to $44.02 billion. Its non-GAAP profit of $2.78 per share was 4.3% above analysts’ consensus estimates.

Is now the time to buy General Motors? Find out by accessing our full research report, it’s free.

General Motors (GM) Q1 CY2025 Highlights:

- Revenue: $44.02 billion vs analyst estimates of $42.85 billion (2.3% year-on-year growth, 2.7% beat)

- Adjusted EPS: $2.78 vs analyst estimates of $2.66 (4.3% beat)

- Reassessing its 2025 financial guidance and suspending additional buybacks due to cost increases and uncertainty regarding tariffs

- Operating Margin: 7.6%, down from 8.7% in the same quarter last year

- Free Cash Flow Margin: 9.6%, up from 0.9% in the same quarter last year

- Market Capitalization: $45.65 billion

Company Overview

Founded in 1908 by William C. Durant, General Motors (NYSE:GM) offers a range of vehicles and automobiles through brands such as Chevrolet, Buick, GMC, and Cadillac.

Sales Growth

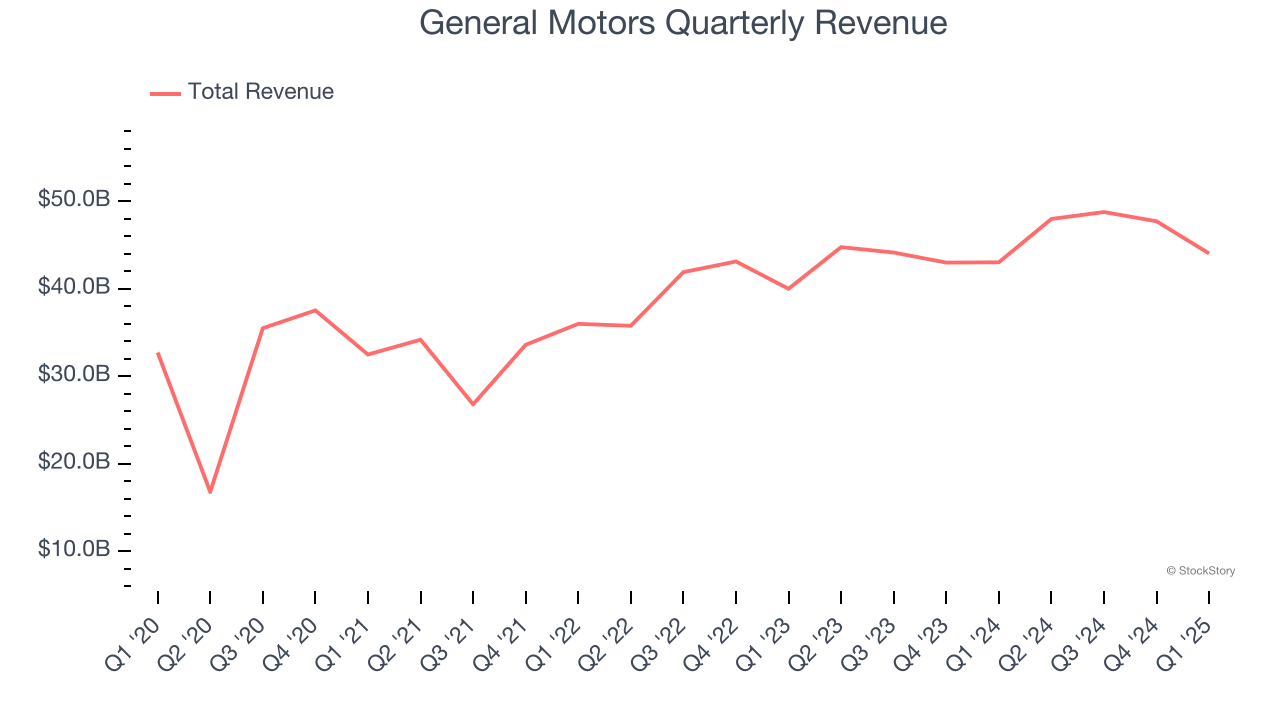

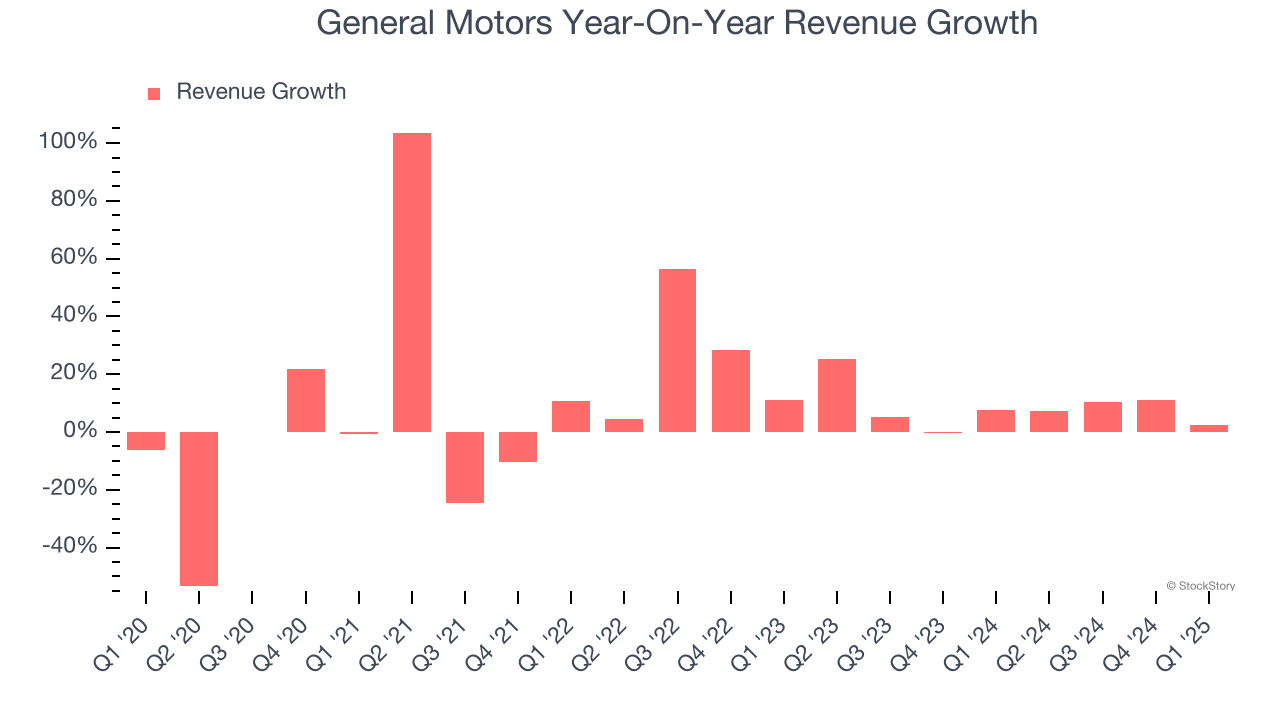

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, General Motors’s 6.9% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. General Motors’s annualized revenue growth of 8.3% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, General Motors reported modest year-on-year revenue growth of 2.3% but beat Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to decline by 5.6% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

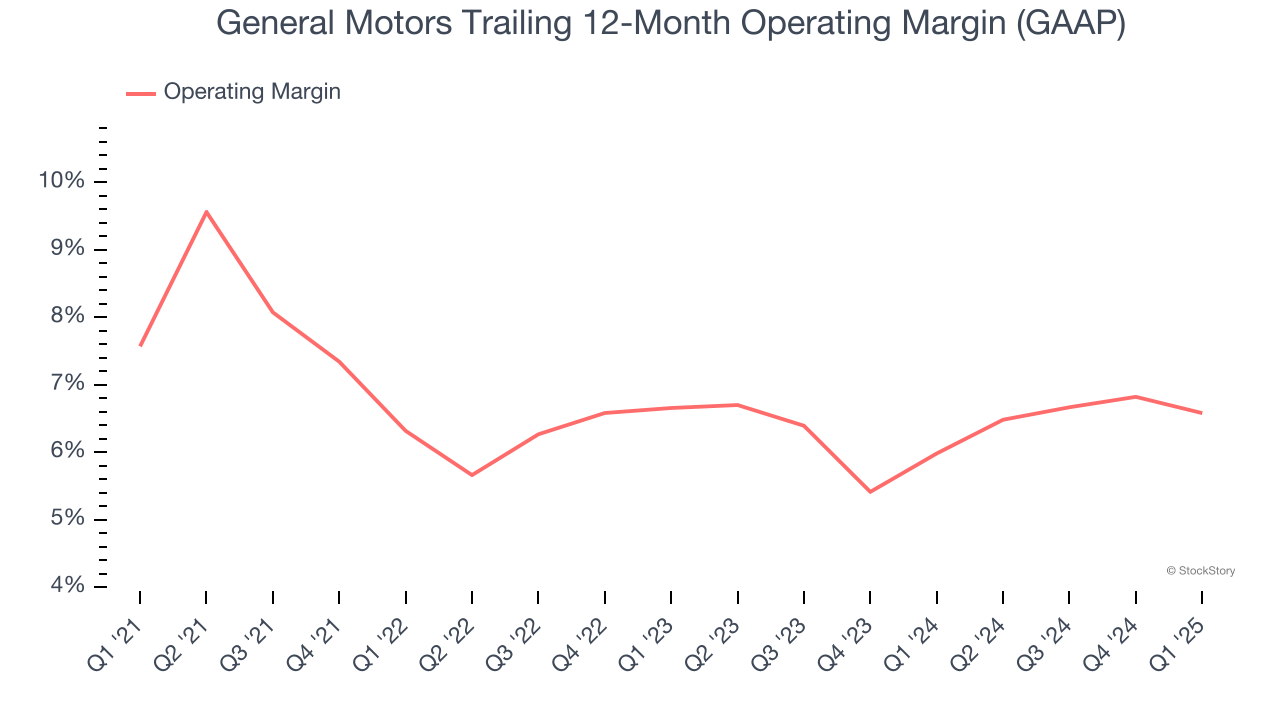

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

General Motors was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.6% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, General Motors’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, General Motors generated an operating profit margin of 7.6%, down 1.1 percentage points year on year. The reduction is quite minuscule and shareholders shouldn’t weigh the results too heavily.

Earnings Per Share

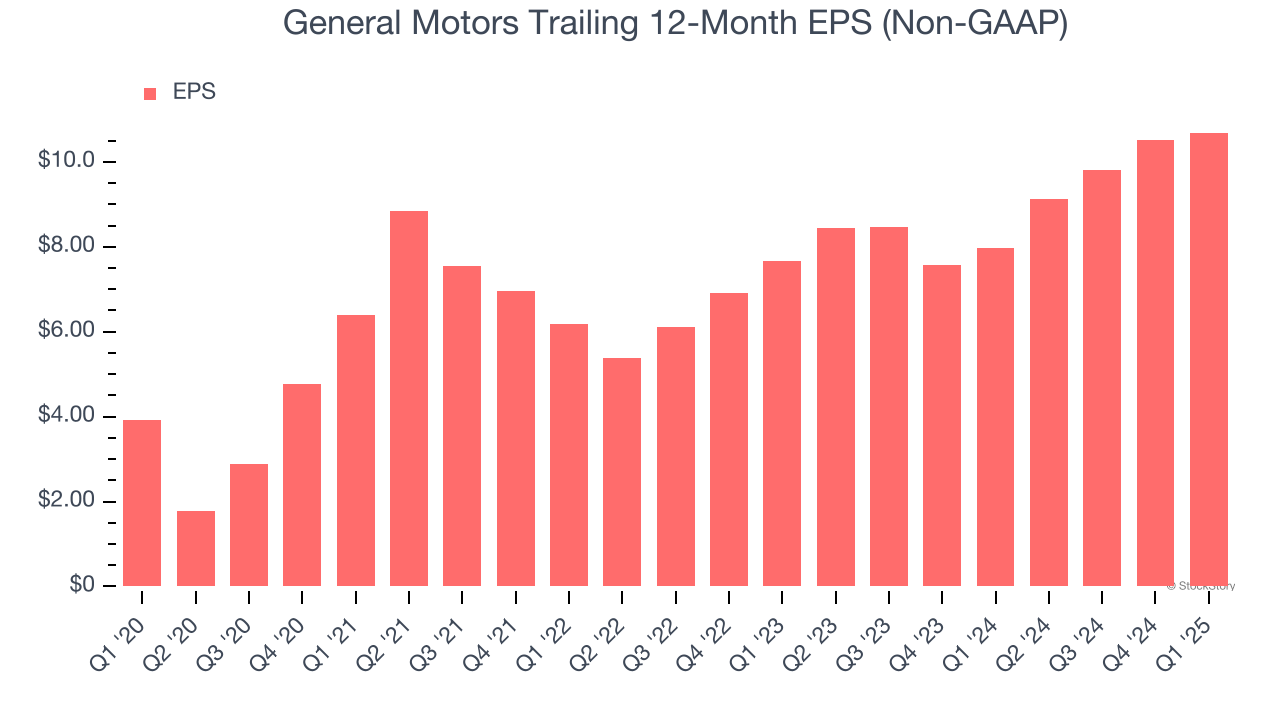

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

General Motors’s EPS grew at an astounding 22.2% compounded annual growth rate over the last five years, higher than its 6.9% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

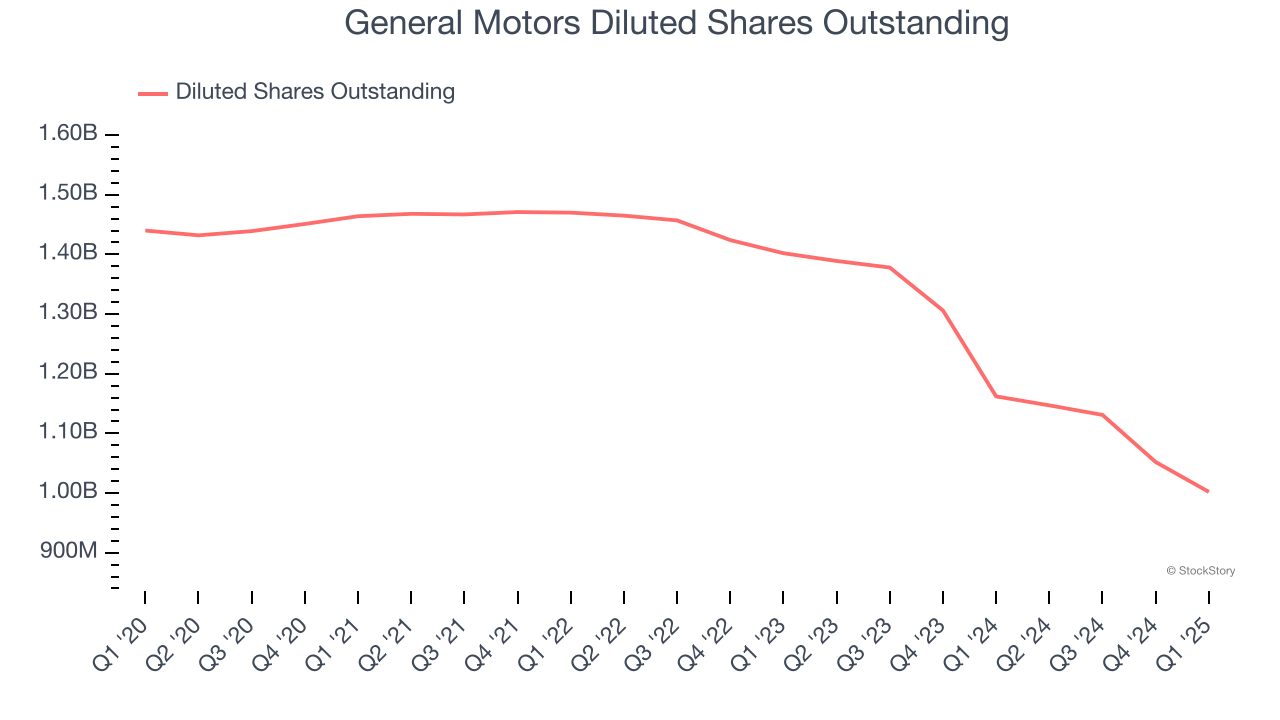

We can take a deeper look into General Motors’s earnings quality to better understand the drivers of its performance. A five-year view shows that General Motors has repurchased its stock, shrinking its share count by 30.4%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For General Motors, its two-year annual EPS growth of 18.1% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q1, General Motors reported EPS at $2.78, up from $2.61 in the same quarter last year. This print beat analysts’ estimates by 4.3%. Over the next 12 months, Wall Street expects General Motors’s full-year EPS of $10.69 to grow 2.2%.

Key Takeaways from General Motors’s Q1 Results

We enjoyed seeing General Motors beat analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, uncertainty remains. The company is reassessing its 2025 financial guidance and suspending additional buybacks due to cost increases and uncertainty regarding tariffs. The stock traded down 2.3% to $46.12 immediately after reporting.

So do we think General Motors is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.