Articles from Personetics

Personetics, the global leader in AI-powered Cognitive Banking, today announced the launch of PrimacyEdge, a groundbreaking product designed to help banks achieve primacy by understanding their customers’ relationships with other financial institutions and providing a personalized, programmatic approach to strengthening loyalty and increasing share of wallet. PrimacyEdge is part of Personetics’ Engage product suite.

By Personetics · Via Business Wire · September 17, 2025

Personetics, the global leader in AI-driven Cognitive Banking, today announced the launch of Personetics MCP Server, which enables banks to develop and deploy Agentic AI applications leveraging Personetics’ sophisticated financial models and actionable insights.

By Personetics · Via Business Wire · September 11, 2025

KeyBank (NYSE: KEY), one of the nation’s largest financial services companies, is further advancing its mission to empower clients to thrive by utilizing Personetics’ Cognitive Banking platform, which fosters deep personal relationships and assists consumers in achieving their financial goals.

By Personetics · Via Business Wire · June 2, 2025

Personetics, the global leader in financial data-driven personalization and customer engagement, today announced that Celent recognized its platform as superior to other fintech solutions in enabling banks to become “challengers” in small business (SMB) banking. Celent, a leading research and advisory firm for the financial services industry, profiled eight fintech companies and their capabilities, including Personetics, that are powering banks and credit unions’ value propositions for SMBs. Celent published its findings in a report “Become a Challenger in Small Business Banking: Embedding Fintech.”

By Personetics · Via Business Wire · May 24, 2023

Personetics, the global leader in financial data-driven personalized customer engagement, today announced its integration with Q2’s Digital Banking Platform, via the Q2 Partner Accelerator Program. Q2 Holdings, Inc. (NYSE: QTWO) is a leading provider of digital transformation solutions for banking and lending. As part of the Q2 Partner Accelerator Program, financial institutions will be able to purchase Personetics and then offer its solution directly through Q2’s Digital Banking Platform, further expanding Personetics’ reach within financial institutions (FIs).

By Personetics · Via Business Wire · May 2, 2023

Personetics, the global leader in financial data-driven customer engagement, today released a report titled “Spotlight on North America: Banks and Credit Unions Need to Promote Customers’ Financial Well-Being.” The report, based on a study conducted by Forrester Consulting on behalf of Personetics, details the opportunities and challenges associated with enhancing customer engagement and loyalty and increasing customer lifetime value.

By Personetics · Via Business Wire · January 31, 2023

Personetics, the leading global provider of financial data-driven personalization and customer engagement solutions for banks and financial services providers, has today announced the release of the first episode of their new bi-weekly podcast, ‘Banking on Innovation’.

By Personetics · Via Business Wire · October 13, 2022

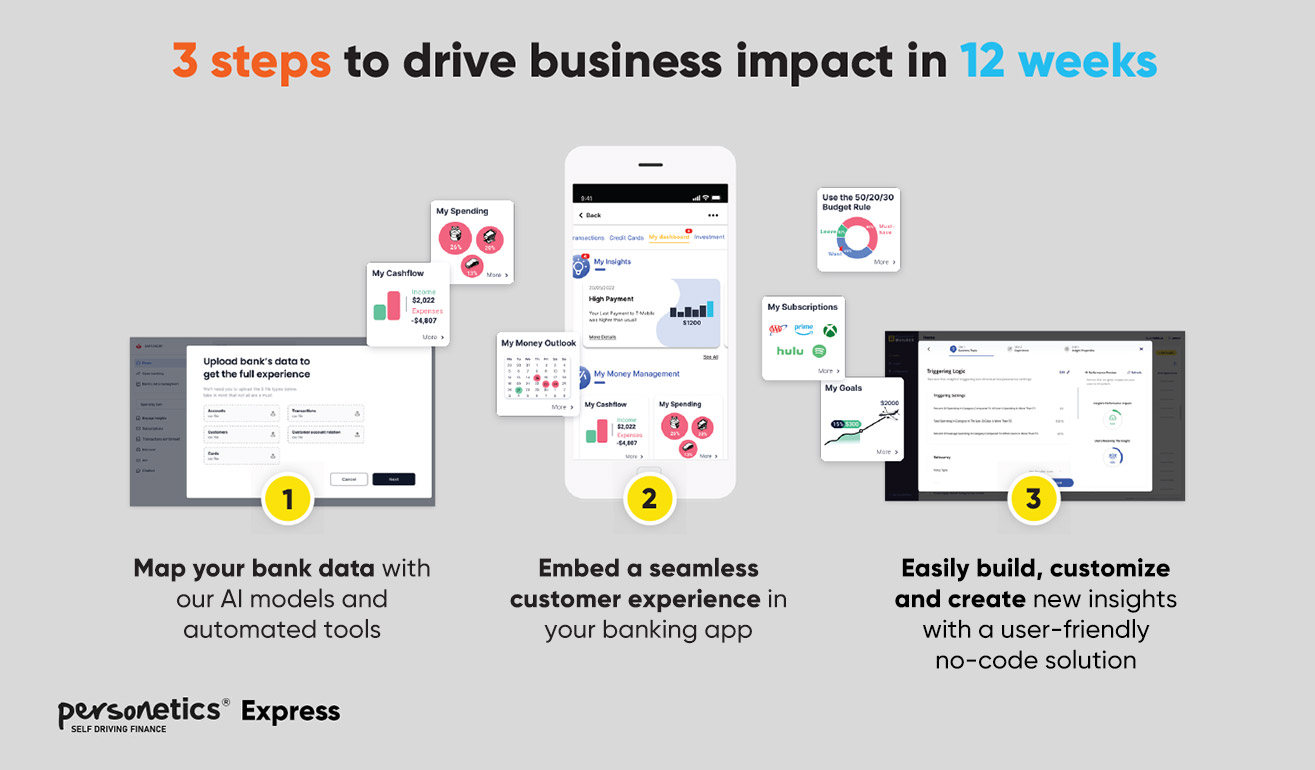

Personetics, the leading global provider of financial data-driven personalization, customer engagement, and advanced money management capabilities for financial institutions, today announced the launch of Personetics Express. The new offering is aimed at midsize financial institutions (those with $5B-$50B in assets), providing an out-of-the box, global winning solution that is powerful enough to compete with enterprise banks and delivers a quick business impact, while fitting smaller institutions’ budgets and timelines.

By Personetics · Via Business Wire · September 12, 2022

As inflation and living costs hit record levels across the globe, people are calling on their banks to better support them through the cost-of-living crisis. That’s according to a new study of 5,000 banking customers worldwide by Personetics, conducted by Censuswide, which warns customers are disappointed by their banks’ reaction to date and are prepared to switch to competitors who can offer a higher level of personalized service.

By Personetics · Via Business Wire · June 30, 2022

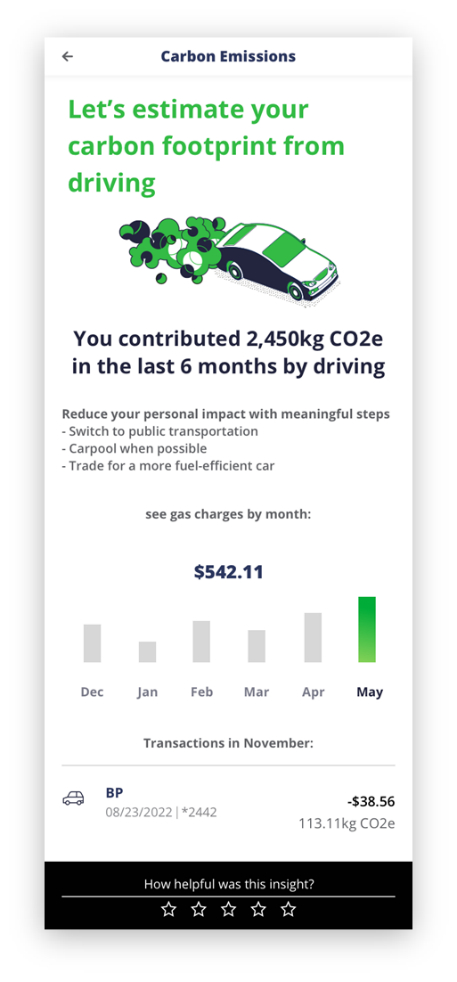

Personetics, the leading global provider of financial data-driven personalization, customer engagement, and advanced money management capabilities for financial institutions, today announces the launch of Sustainability Insights. This new offering, included within the Personetics engagement platform, will help banks meet growing customer demand and regulatory expectations for environmentally responsible banking and sustainable finance. Personetics is partnering with industry-leading impact fintech ecolytiq, whose Sustainability-as-a-Service® solution enhances the data models of Sustainability Insights, making them more precise, personalized, and actionable.

By Personetics · Via Business Wire · April 26, 2022

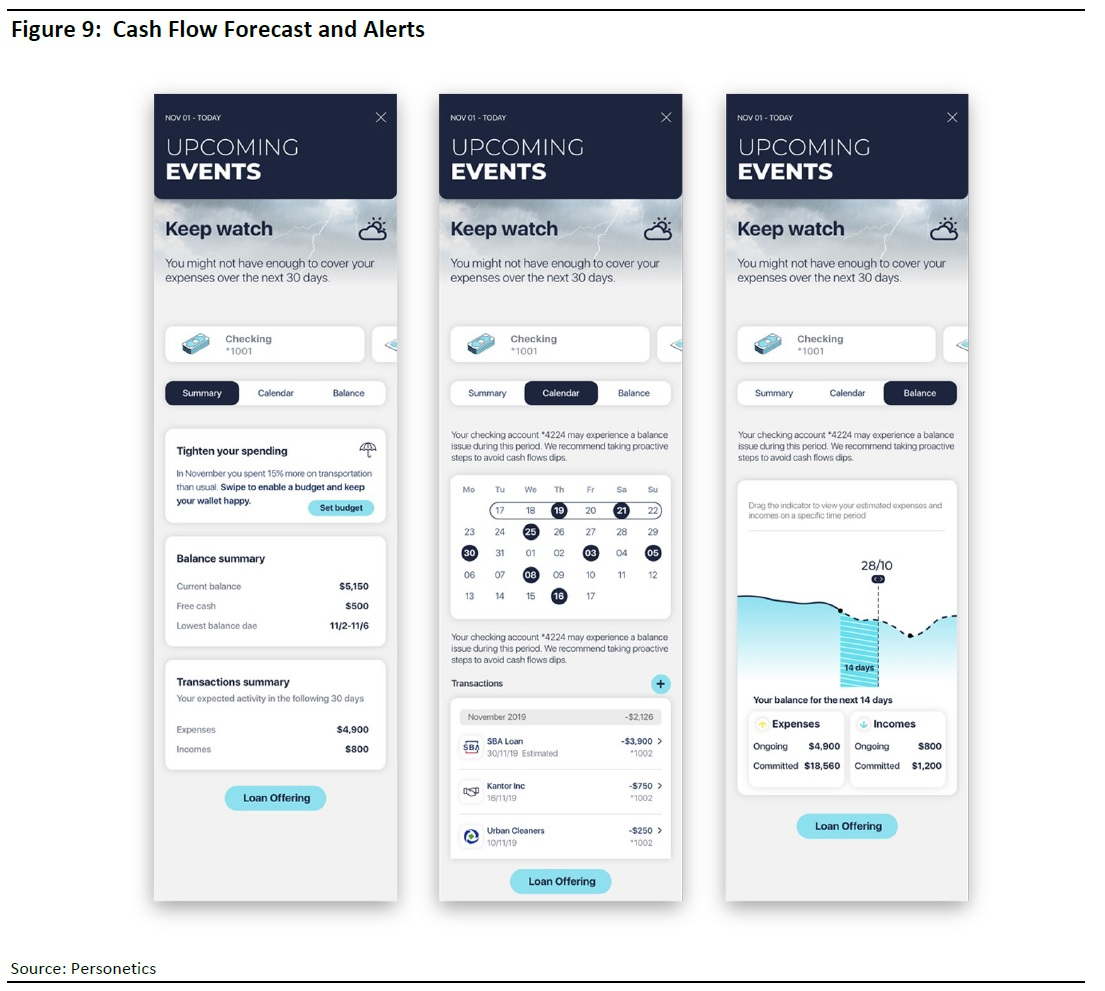

Personetics, the leading global provider of financial data-driven personalization and customer engagement solutions for financial institutions, today announces the world’s first suite of “Proactive Cash Flow Management” capabilities to help banks face the growing competitive, regulatory and consumer requirements to combat overdrafts.

By Personetics · Via Business Wire · April 13, 2022

Personetics, the leading global provider of financial-data-driven personalization and customer engagement solutions for banks and financial services providers, today announced it has raised $85m in growth funding from Thoma Bravo, a leading software investment firm. Personetics secured a total funding of over $160 million in 2021. Personetics is backed by Viola Ventures, Lightspeed Ventures, Sequoia Capital, Nyca Partners and Warburg Pincus.

By Personetics · Via Business Wire · January 19, 2022

Personalized insights and advice will transform wealth management and provide enormous value to customers, if the industry embraces a more personalized approach. Personalized advice is a key step on the journey to autonomous finance, which involves four stages: data enrichment; personalized insights and advice; unified advice across channels; and finally, autonomous finance. This was the message shared by Jody Bhagat, President of Americas at Personetics, when he addressed this month’s SEC meeting of the Asset Management Advisory Committee (AMAC).

By Personetics · Via Business Wire · November 8, 2021

KBC, a leading multi-channel bank-insurance group with a geographic focus in Europe, has partnered with Personetics, the leading global provider of financial-data-driven personalization and customer engagement solutions for financial services. The companies will be working together to deliver multi-lingual, proactive, data-driven solutions to increase customer engagement on KBC's mobile application to meet customer needs.

By Personetics · Via Business Wire · September 30, 2021