Ford Motor (F)

13.80

+0.08 (0.58%)

NYSE · Last Trade: Feb 7th, 5:04 PM EST

Given the scope of the automotive sector, investors might be interested in Ford.

Via The Motley Fool · February 7, 2026

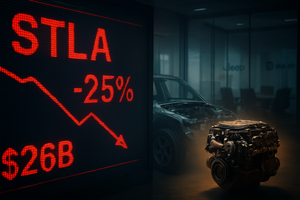

The global automotive landscape was jolted on February 6, 2026, as Stellantis N.V. (NYSE: STLA) saw its shares plummet by 25% following the announcement of a massive €22.2 billion ($26 billion) one-time charge. The staggering write-down is the cornerstone of a radical "business reset" orchestrated by new leadership

Via MarketMinute · February 6, 2026

As the global automotive industry navigates a volatile transition toward electrification, Ford Motor Company (NYSE: F) finds itself at a defining crossroads. The Dearborn-based automaker is scheduled to release its fourth-quarter 2025 financial results on February 10, 2026, with Wall Street analysts laser-focused on a consensus earnings-per-share (EPS) estimate of

Via MarketMinute · February 6, 2026

AMSTERDAM — In a day of unprecedented volatility for the global automotive sector, Stellantis NV (NYSE: STLA) saw its stock price crater by more than 24% on Friday, February 6, 2026. The collapse followed a grim financial disclosure in which the world’s fourth-largest automaker announced a staggering €22.2 billion

Via MarketMinute · February 6, 2026

Investors were surprised by the cost of Stellantis's EV reset, and not in a good way.

Via The Motley Fool · February 6, 2026

Stellantis grapples with a monumental EV setback—one analyst calls it the "biggest capital allocation mistake" in auto history—joining peers in massive write-downs while its undervalued stock draws cautious analyst optimism.

Via Barchart.com · February 6, 2026

What's going on in today's session: S&P500 most active stockschartmill.com

Via Chartmill · February 6, 2026

Stellantis stock crashes as management announces a €22.2 billion ($26.5 billion) impairment charge. Here’s why STLA shares are not worth owning following the valuation haircut.

Via Barchart.com · February 6, 2026

GM's financial performance in 2025 cut through a lot of industry noise, and what investors need to hear is clear.

Via The Motley Fool · February 6, 2026

As of February 6, 2026, the North American energy landscape has reached a historic inflection point. The frantic merger and acquisition (M&A) wave that gripped the industry between 2023 and 2025 has largely transitioned into an intensive integration phase, fundamentally reshaping the sector into a more concentrated market dominated

Via MarketMinute · February 6, 2026

As of February 6, 2026, the American economy finds itself in a precarious balancing act. The "Liberation Day" tariffs, a cornerstone of the current administration’s trade policy, have successfully reshaped supply chains but at a significant cost: "sticky" goods inflation. While services inflation has largely cooled, the persistent rise

Via MarketMinute · February 6, 2026

Date: February 6, 2026 Introduction As of early 2026, Tesla (Nasdaq: TSLA) finds itself at the most critical juncture since the 2018 "Model 3 production hell." No longer just a high-growth electric vehicle manufacturer, Tesla is aggressively rebranding itself as a "Physical AI" and robotics powerhouse. This transition comes at a time when its core [...]

Via Finterra · February 6, 2026

Date: February 6, 2026 Introduction The high-stakes world of prestige beauty was sent into a tailspin yesterday as The Estée Lauder Companies Inc. (NYSE: EL) witnessed a dramatic 19.2% collapse in its share price. The sell-off, which represents one of the steepest single-day declines in the company’s nearly 80-year history, came on the heels of [...]

Via Finterra · February 6, 2026

Ford is America's oldest automaker, and it's set to potentially become its largest over the next five years.

Via The Motley Fool · February 6, 2026

The global economic landscape has been jolted in the opening weeks of 2026 as the United States government formalizes a series of aggressive 25% tariff proposals targeting the critical sectors of semiconductors, automobiles, and pharmaceuticals. These measures, framed as essential for national security and domestic industrial revitalization, have sent shockwaves

Via MarketMinute · February 5, 2026

Curious about the most active S&P500 stocks in today's session?chartmill.com

Via Chartmill · February 5, 2026

As the calendar turns to early February 2026, the global financial community is fixated on 1 First Street NE, Washington, D.C. The Supreme Court of the United States is expected to issue a final ruling in Learning Resources, Inc. v. Trump, a consolidated case that challenges the legality of

Via MarketMinute · February 5, 2026

If you're only considering dividends when comparing value returned to shareholders, you'll miss hidden gems such as General Motors.

Via The Motley Fool · February 5, 2026

As of February 5, 2026, United Rentals, Inc. (NYSE: URI) finds itself at a critical crossroads that perfectly encapsulates the current state of the American industrial economy. Long considered the "canary in the coal mine" for the construction and infrastructure sectors, the world’s largest equipment rental company has recently transitioned from a period of euphoric [...]

Via Finterra · February 5, 2026

As of February 5, 2026, Tesla Inc. (NASDAQ: TSLA) finds itself at the most critical juncture in its twenty-year history. Once viewed primarily as a disruptor of the internal combustion engine, the company has spent the last 24 months aggressively shedding its skin as a traditional automaker. Today, Tesla is increasingly valued and analyzed as [...]

Via Finterra · February 5, 2026

Rivian is an innovative EV company making some neat trucks and SUVs, but is it a buy at these prices?

Via The Motley Fool · February 5, 2026

Canadian PM considering scrapping EV mandate for revised fuel standards and EV Credits, mulls EV rebate comeback.

Via Benzinga · February 5, 2026

Adient (ADNT) Q1 2026 Earnings Call Transcript

Via The Motley Fool · February 4, 2026

Ford Motor is reportedly in discussions with Geely for a potential partnership, that could see Geely utilizing Ford's factory space in Europe.

Via Benzinga · February 4, 2026